Weekly Performance Review – Week Ending June 14, 2025

Trade the Tape—Before It Hits the Headlines.

This week offered a real-time test of my multi-time-frame methodology. On Sunday I published three trade road-maps; by Friday every one of them had hit—or cleanly exceeded—its first objective. Below is a quick replay of what we saw, why it mattered, and how readers were able to trade it.

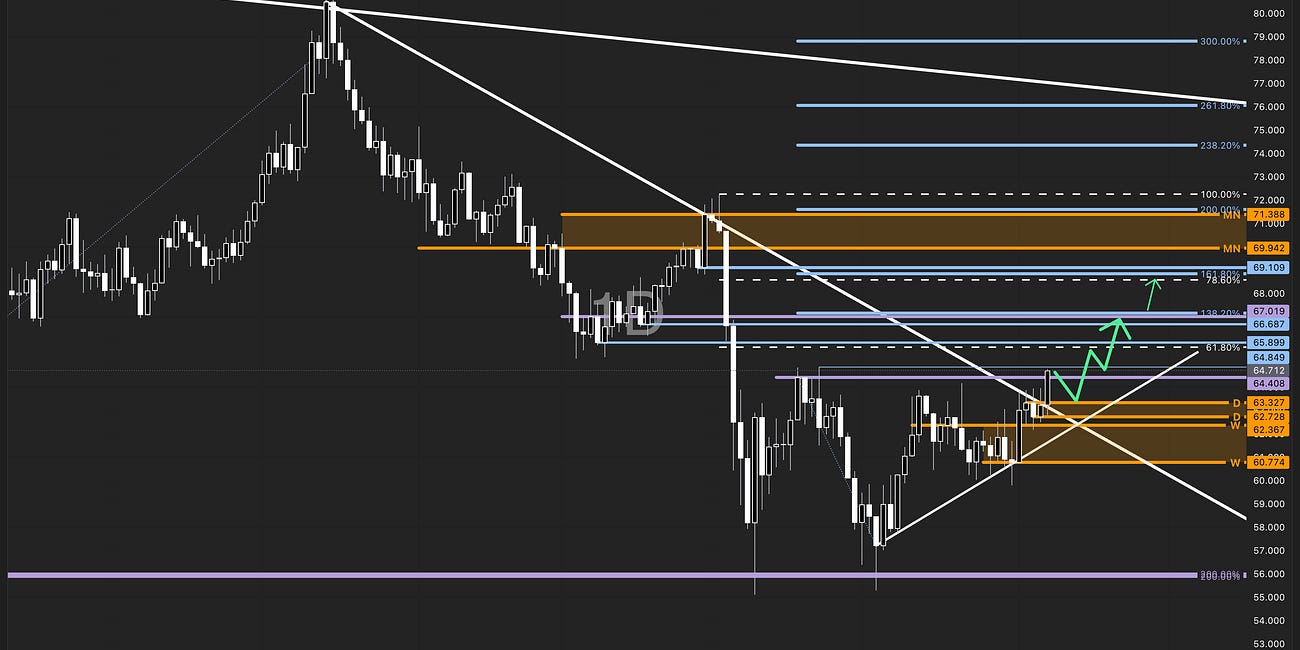

Crude Oil – “Trend Collision: Short-Term Longs in the Monthly Down-Channel”

(published 8 June 2025)

Trend Collision in Crude Oil: Short-Term Longs in the Monthly Down Channel

Long-Term Bearish Channel Intact

My call

Counter-trend long while the weekly pivot $60.77–62.36 held.

Upside objectives $65.70 → $66.60 → $69-71 (major resistance cluster).

What happened

WTI opened Monday near $65 and, turbo-charged by the Israel-Iran flare-up, spiked to $72.98 on 13 June, printing an intraday high $77.62—comfortably through the top of my resistance box.

Why it matters

Price not only reached the primary $69-71 cluster but proved the power of confluent Fibonacci + trend-line zones to identify high-odds reactions—even in headline-driven markets.

2. Gold – “Decision Zone After Reaching Long-Term Targets”

(published 11 June 2025)

My call

Gold had tagged the monthly 300 % Fibonacci extension and entered a multi-time-frame reaction zone (green box).

Two-way play: reclaim the box for fresh highs or lose it for a deeper pull-back.

What happened

Bulls defended the zone the very next session; spot gold lifted from $3,355 (11 Jun) to $3,433 (14 Jun), a +2.3 % bounce that sets up the Daily Fibonacci 100 / H4 161.8 targets next.

Why it matters

The move underlines how reaction-zones rule trend continuation; by waiting for the reclaim, risk-to-reward skewed 4-to-1 in the bulls’ favour and kept us out of a whipsaw short.

3. Nasdaq 100 – “Bullish Expansion Phase”

(published 8 June 2025)

Nasdaq 100: Bullish Expansion Phase

US100 (NASDAQ 100) Technical Analysis – Full Trend Alignment Points to Expansion

My call

Breakout confirmed; short-term target 21,930-22,000, then 22,800 / 23,200 / 23,900.

Invalidated only below the daily pivot 21,473.

What happened

By Wednesday the index printed 22,041.83, pipping my first band within three sessions before a healthy pull-back to 21,631 on Friday—still well above the pivot.

Why it matters

A text-book expansion-phase play: price bursts, tags objective, then consolidates—offering fresh entries while structure stays intact.

Key Take-Aways for Subscribers

Structure first, headlines second. When technical levels align across time-frames, even geopolitics tends to respect them.

Reaction zones > predictions. I don’t guess; I wait for price to confirm the scenario with a reclaim or break.

Clear invalidation keeps draw-downs small. Each idea came with a precise “fold” level, letting traders size with confidence.

🔥 Liked this results-driven breakdown?

Hit Subscribe to get these trade maps before the moves happen, every week.

Follow The Market Flow!