DAX: Short-Term Rally vs Long-Term Correction

Short-term upside possible, long-term caution still warranted.

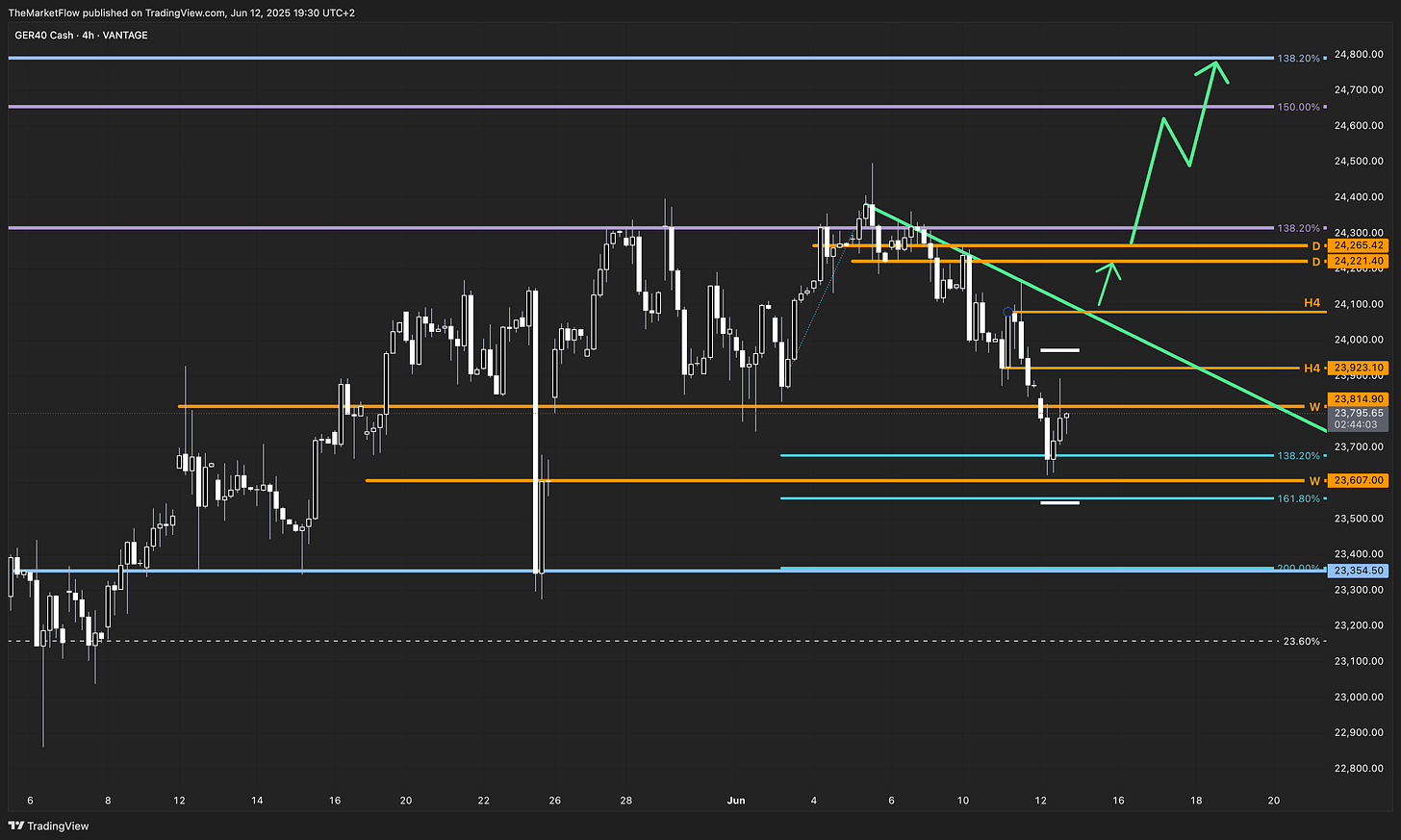

In my previous analysis, Signs of Exhaustion at Long-Term Targets, I highlighted that GER40 had likely completed a major bullish leg by reaching the weekly Fibonacci 138.2 target. Since then, the market pulled back as expected and found support at the H4 Fibonacci 138.2, where a bounce may begin to unfold.

While this may evolve into a bear market rally, it’s important to note that the correction structure is still intact on the higher timeframes.

Multi-Timeframe Structure

4H Chart:

The price may react to the H4 138.2 target and may initiante a bounce.

The descending trendline still defines the active countertrend structure.

A confirmed breakout above 24,080 (a key H4 pivot level) would shift short-term momentum and potentially open the way to 24,221–24,265, a significant resistance zone derived from the daily timeframe.

Above this zone, both the daily 138.2% and the weekly 150% Fibonacci extensions become active targets, projected around 24,500–24,700.

Daily Chart:

The correction phase is still unfolding.

The recent bounce may be part of a larger corrective wave.

The 24,221–24,265 zone represents the primary resistance. A failure to break above this area may lead to continuation of the correction.

If rejection occurs, the next downside targets include:

23,354: an area of prior support and the H4 200% expansion / daily breakout

22,363: the daily 38.2% Fibonacci retracement level, in line with previous daily breakout

Key Levels

Upside triggers:

24,080: H4 pivot, first structural breakout level

24,221–24,265: Daily breakdown zone and short-term resistance

24,500–24,700: Daily and weekly Fibonacci target confluence

Downside triggers:

23,607: Weekly pivot zone, major support

23,354: Key support and Fibonacci expansion level

22,363: Major correction target (daily 38.2% retracement)

Conclusion

We may be at a key inflection point. A decisive move above the descending trendline and a close above the daily breakdown zone would shift momentum to the upside. Until then, the structure remains corrective, and further downside cannot be ruled out.

This is a time for caution and confirmation. Let the structure guide your decisions.

If you find this analysis helpful, feel free to comment or reply to this post with the market you’d like me to cover next.