DoorDash (NASDAQ:DASH) | Multi-Timeframe Expansion Setup

Bullish alignment across all timeframes with expansion trigger in focus

The Market Flow | October 30, 2025

Company Overview

DoorDash Inc. operates a logistics platform connecting consumers with merchants for food, grocery, and retail delivery. Revenue is generated primarily through delivery fees, merchant commissions, and DashPass subscriptions. The company holds a leading share in the U.S. delivery market and continues expanding into new verticals such as grocery and retail.

DoorDash fits the fast grower category — a business reinvesting aggressively into market reach and operational efficiency, prioritizing scale and margin improvement over short-term profitability.

Technical Overview

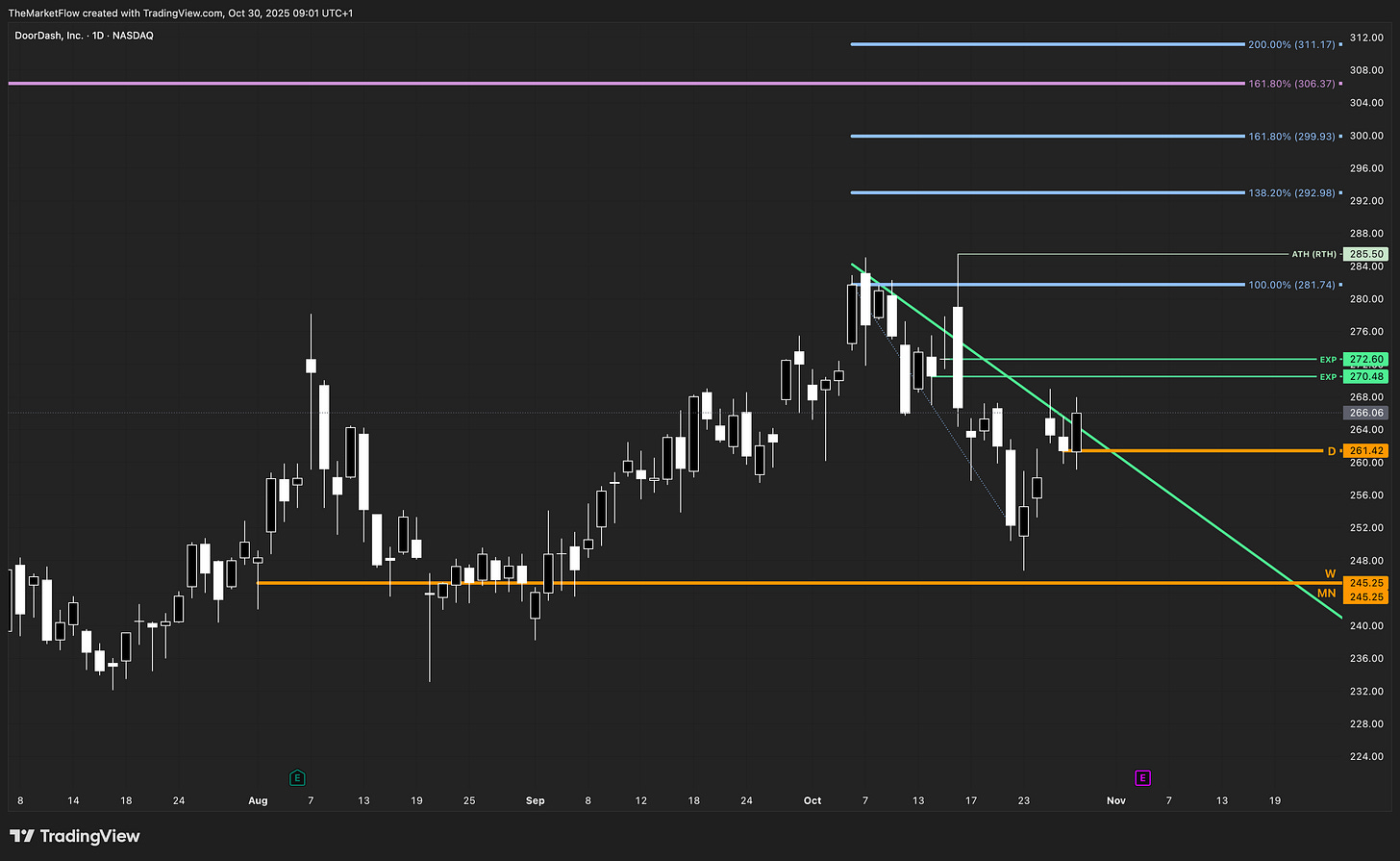

Monthly:

The monthly structure remains decisively bullish after September’s close above the 138.2% Fibonacci extension, confirming continuation toward the 161.8% target at 306.37. The monthly pivot holds at 245.25, defining long-term structural support and bias continuation within the expansion phase.

Weekly:

The weekly candle tested the prior breakout pivot and rejected it with a pronounced lower wick, signaling sustained institutional demand around the 245–246 zone. Structure remains intact and aligned with the monthly expansion path.

Daily:

The bearish countertrend has been invalidated following a confirmed 1-2-3 reversal wave back above the most recent pivot. This confirms a daily trend shift to bullish, opening path toward expansion. The first clean breakout sits at EXP 270.48, establishing the lower boundary of the expansion zone.

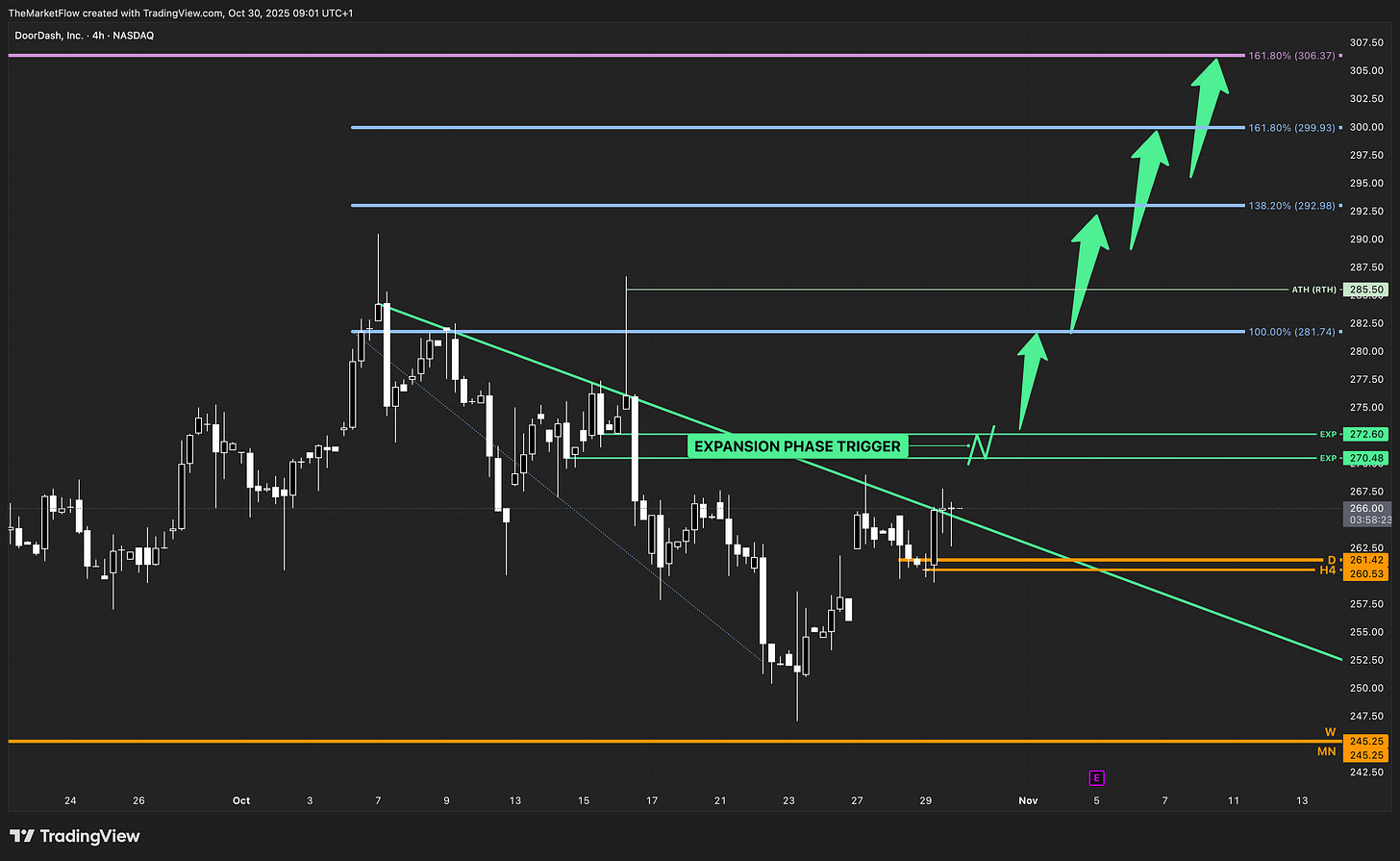

H4:

Short-term structure confirms accumulation below the expansion zone (270.48–272.60). The higher of these, EXP 272.60, defines the trigger for full expansion. Consistent impulsive closes above 272.60 would activate the daily Fibonacci targets — 281.74, 292.99, 299.93, and the monthly 161.8 @ 306.37. The active H4 pivot at 260.53 defines structural invalidation.

Trade Structure & Levels

Bias: Long above Weekly Pivot 245.25

Phase: Accumulation → Expansion Setup

Trigger: H4 close above 272.60

Invalidation: H4 close below 260.53

Path → 281.74 → 292.99 → 299.93 → 306.37

Risk & Event Context

Earnings-season volatility may affect short-term behavior. Broader equity sentiment, particularly linked to inflation and labor data, remains the dominant macro driver for NASDAQ-based names like DoorDash. No major company-specific catalysts currently scheduled.

Conclusion

All timeframes from Monthly through H4 align in bullish configuration. Price is consolidating immediately below the expansion zone; a confirmed close above 272.60 would transition the structure into full expansion, unlocking the higher Fibonacci sequence toward 306.

Disclaimer

This publication is provided for informational and educational purposes only and does not constitute investment advice, a solicitation, or a recommendation to buy or sell any security, derivative, or financial instrument. The analysis and opinions expressed reflect the author’s views at the time of writing and are subject to change without notice.

All information is derived from publicly available sources believed to be reliable, but accuracy and completeness are not guaranteed. Past performance is not indicative of future results, and no representation or warranty is made regarding future price behavior or outcomes.

Readers are solely responsible for their own investment decisions and should consult a qualified financial advisor before acting on any information contained herein.

The author and/or affiliates may hold, trade, or have a financial interest in the securities or instruments mentioned in this publication. Neither the author nor any associated party accepts liability for any direct or consequential loss arising from the use of this material.