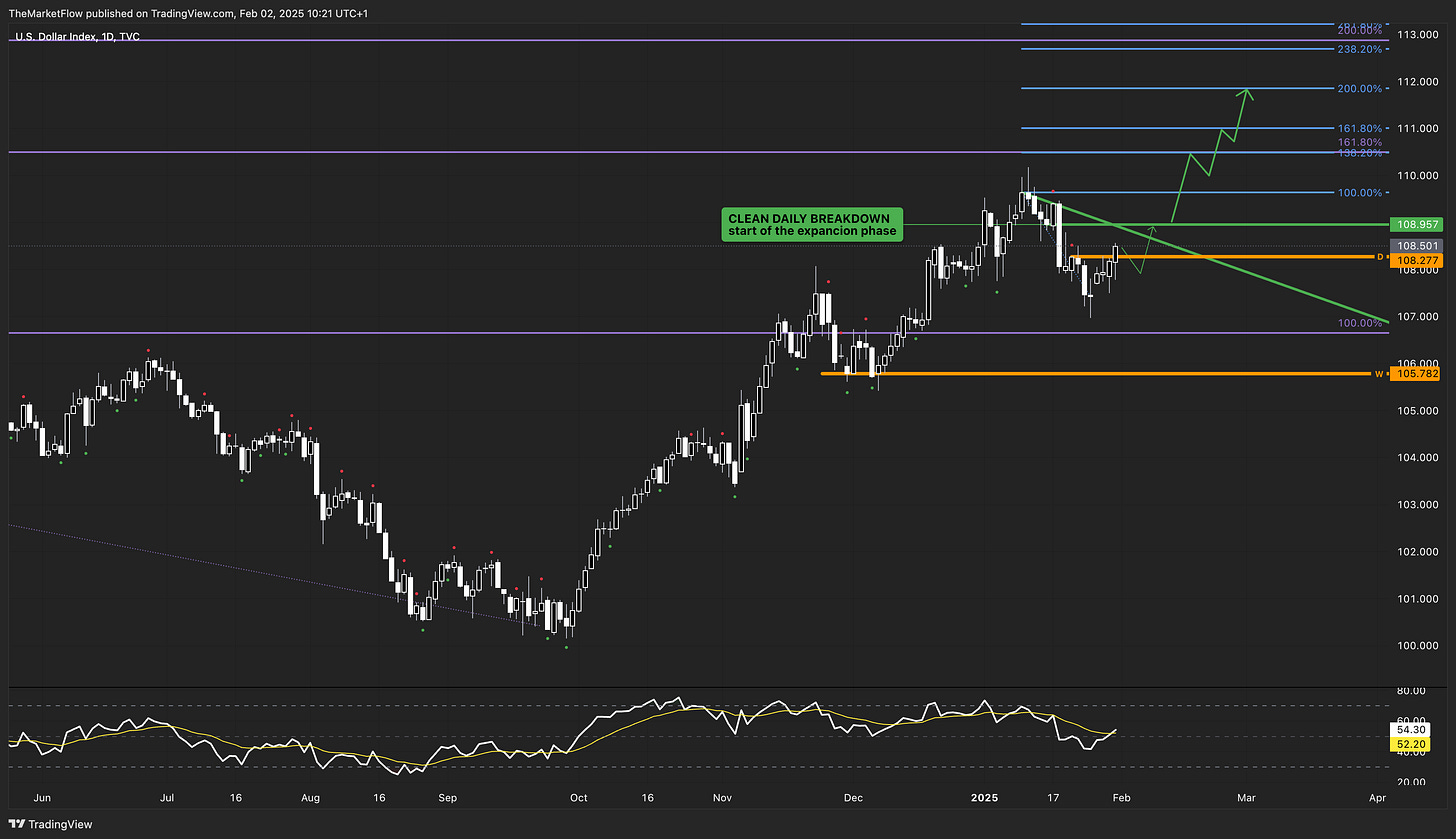

Key Chart (Daily)

There is a healthy correction in the valid weekly long trend, and the daily closed above the previous short impulse base.

The market is in the accumulation phase, turning into expansion above the clean daily breakdown where the countertrend breaks.

From there, the Fibonacci levels become valid targets.

Key Fundamentals

Summary

The U.S. dollar (USD) remains strong as tariff tensions escalate following President Donald Trump’s announcement of new tariffs on Canada, Mexico, and China. Combined with robust U.S. economic performance and a hawkish Federal Reserve stance, the dollar has continued to appreciate against major currencies (Financial Times).

Key Factors

Tariff War and Global Trade Impact:

The U.S. administration has imposed a 25% tariff on Canadian and Mexican imports, alongside a 10% tariff on Chinese goods. While Canadian crude oil is subject to a reduced 10% tariff, this move has already triggered retaliatory measures from Canada and Mexico. China, meanwhile, has dismissed the tariffs as an American domestic issue, warning of potential trade disruptions (White House, Reuters).

Economic Performance and Dollar Strength:

The U.S. economy remains resilient, with GDP growth and employment data outperforming expectations. The USD inflation-adjusted exchange rate has reached a 55-year high, reflecting investor confidence in U.S. economic stability (Investopedia).

Federal Reserve’s Hawkish Stance:

The Federal Reserve has maintained its cautious approach to interest rates, opting not to cut rates yet, citing persistent inflation concerns. This decision has attracted foreign investors seeking higher returns on U.S. assets, driving stronger demand for the USD (U.S. Bank).

Geopolitical Risks and Safe-Haven Demand:

Amid rising trade tensions and geopolitical uncertainty, the USD has maintained its status as a global safe-haven asset. Investors are shifting toward U.S. Treasury bonds, reinforcing dollar appreciation (Wall Street Journal).

Actionable Insights

Bullish Case:

Sustained U.S. economic growth and a higher-for-longer rate environment may continue to strengthen the USD.

Global trade disruptions from tariffs could further increase safe-haven demand, pushing the USD higher.

Bearish Case:

Overvaluation concerns could lead to profit-taking and a market correction, as some analysts believe the USD is excessively strong (Financial Times).

Retaliatory tariffs from Canada, Mexico, and China could weigh on U.S. exports, increasing risks of a broader trade war that negatively impacts USD demand.