US10Y – Potential Expansion Phase Aligned Across Timeframes

Triggered by H4 Breakout, Targeting Daily and Weekly Fibonacci Zones

Market Overview

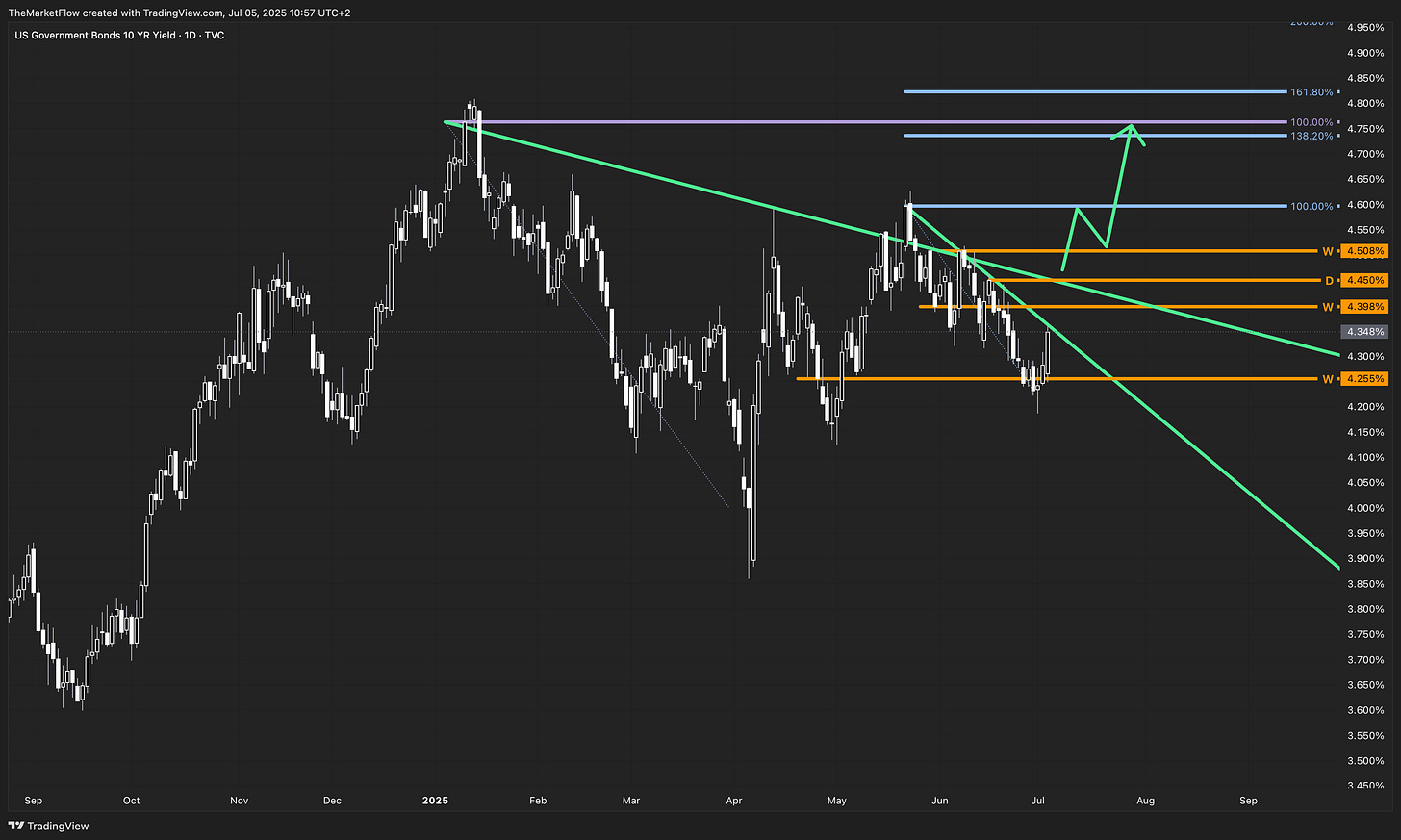

The US10Y structure is now approaching a critical alignment across all major timeframes. While the monthly and weekly long trends remain intact, the recent short countertrend structure on the weekly has held back continuation. However, that may be changing.

Long-Term Outlook

On the weekly and monthly charts, the long trend remains structurally valid. The pullback from the recent highs respected the weekly pivot at 4.255%, which has acted as a support base through the recent cycle. The weekly target Fibonacci zone between 5.05% and 5.23% remains the structural destination if this alignment holds and continuation unfolds.

The Daily Chart

The daily chart shows the key dynamics clearly. The market had been compressing below the downward-sloping countertrend line, bounded by a series of orange-marked pivot levels:

4.255% (weekly pivot)

4.398%, 4.450%, and 4.508% (countertrend daily and weekly pivots)

After retesting the lower boundary, the recent impulse suggests a possible break of the short countertrend. If confirmed, this would align daily structure with the long weekly/monthly trend and activate the higher timeframe targets.

Short-Term Dynamics

The H4 chart has confirmed the first structural breakout. Price has reached the short countertrend line, forming a new impulsive leg after a rejection from the weekly pivot. This sets up a potential continuation move, with room for accumulation above 4.255% and through the pivot levels.

A significant H4 break above the 4.466% zone may now offer continuation setups, supported by the breakout above the short-term green trendline.

Trigger Conditions

Long Trigger: Clean breakout above the H4 green trendline and the clean H4 breakdown at 4.466%.

Short Trigger: Wait for a clean weekly break below the weekly pivot at 4.255%.

Target Zones

Daily Target Fibonacci: 4.60–4.75%

Weekly Target Fibonacci 138.2: 5.05%

Validity

The setup remains valid as long as the price holds above the 4.255% weekly pivot. A sustained breakdown below this level would negate the expansion setup.

What’s your take on US10Y’s alignment? Share your view in the comments!