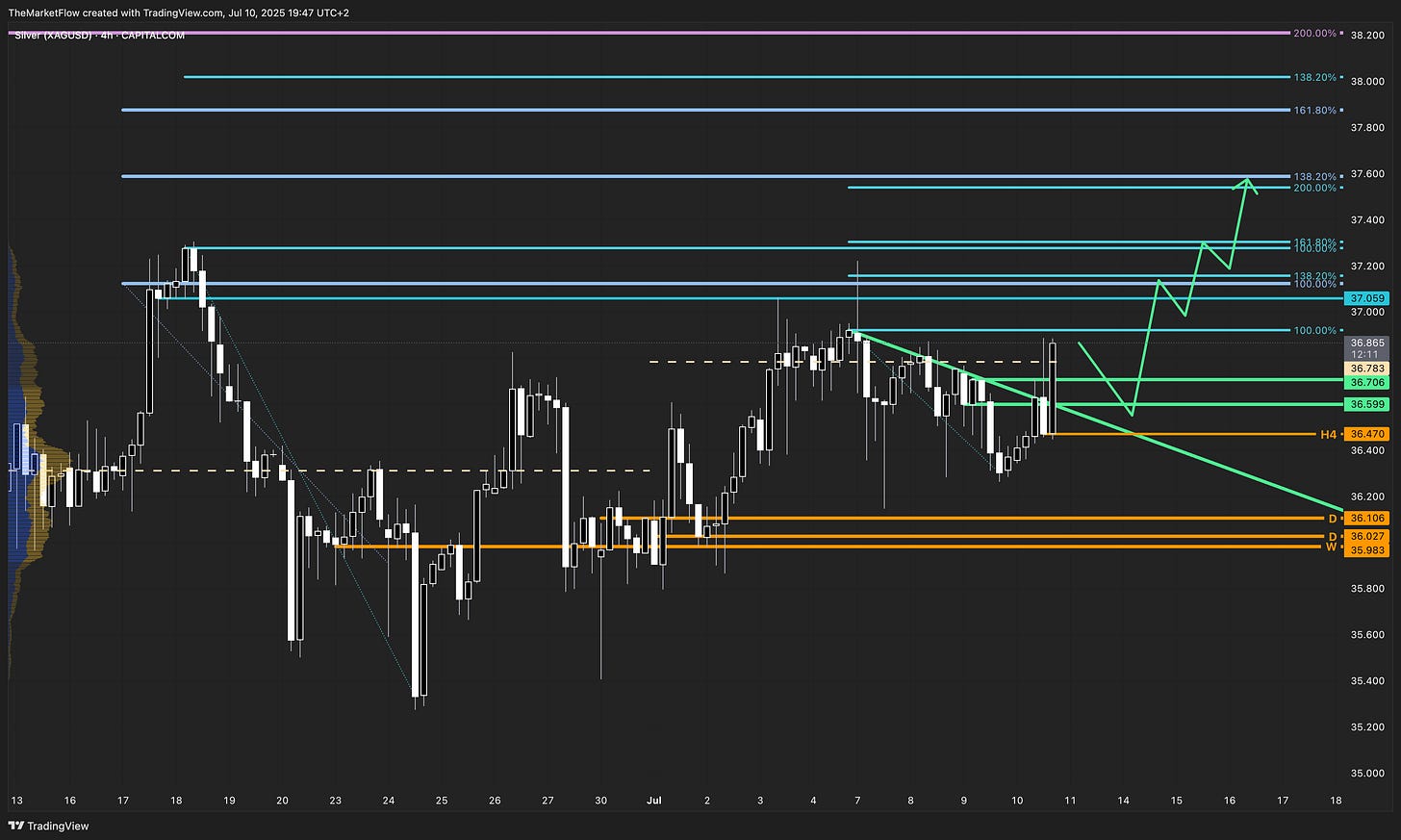

Silver (XAGUSD) – Weekly Continuation Structure Intact, Eyes on Expansion Targets

Bullish trend remains valid across all timeframes with clean H4 breakout and fresh target Fibonacci alignment

Market Overview

Silver continues to trade in alignment with its multi-timeframe bullish structure. Both the weekly and daily charts support ongoing upside momentum, while the recent break of the H4 countertrend confirms a potential expansion phase toward higher target Fibonacci levels.

Long-Term Outlook

The weekly trend remains structurally bullish, with the market holding above the weekly pivot at $35.983. Price recently cleared a prior high, suggesting continuation potential toward the confluence of Fibonacci targets between $38.00–$39.00. The key monthly pivot support at $28.891 remains a major structural guardrail for the long-term trend.

The Daily Chart

The daily structure is in consolidation following a strong impulse leg, with a sustained series of higher lows and higher highs. Daily pivot support remains firm at $35.983, $36.027, and $36.106, forming a well-defined support zone. The clean breakout above the prior high confirms continuation potential if this structure holds.

Target Fibonacci extensions on the daily are stacked between:

$37.05, $37.60, and $38.00–$39.00, aligning with weekly targets.

Short-Term Dynamics

On the H4, the short-term countertrend line has been broken, indicating the start of a new bullish impulse phase. As long as the H4 pivot at $36.470 and the bullish wave structure hold, short-term continuation toward higher Fib zones remains valid.

A minor retest of the breakout zone around $36.60–$36.70 would align with a potential re-entry before targeting:

H4 Fib extensions at $37.20 - $37.60

Trigger Conditions

Long Trigger: Break and hold above H4 countertrend and retest zone near $36.599–$36.706

Short Trigger: None valid while structure holds above daily pivot

Target Zones

H4 Target Fibonacci: $37.20, $37.60

Daily/Weekly Target Zone: $38.00–$39.00

Validity

Daily pivot zone $35.983–$36.106 remains the structural support. A clean break below this would invalidate the bullish continuation thesis and signal the start of a deeper correction.

What’s your take on this silver setup? Do you see the same alignment across timeframes?