NASDAQ: Trend Intact, Bulls Prepare for the Next Leg

Primary uptrend may continue with a minor corrective phase offering opportunity

Long-Term Outlook

The US100 (NASDAQ CFD) remains in a confirmed long trend on all major timeframes, with price action continuing to respect the bullish structure.

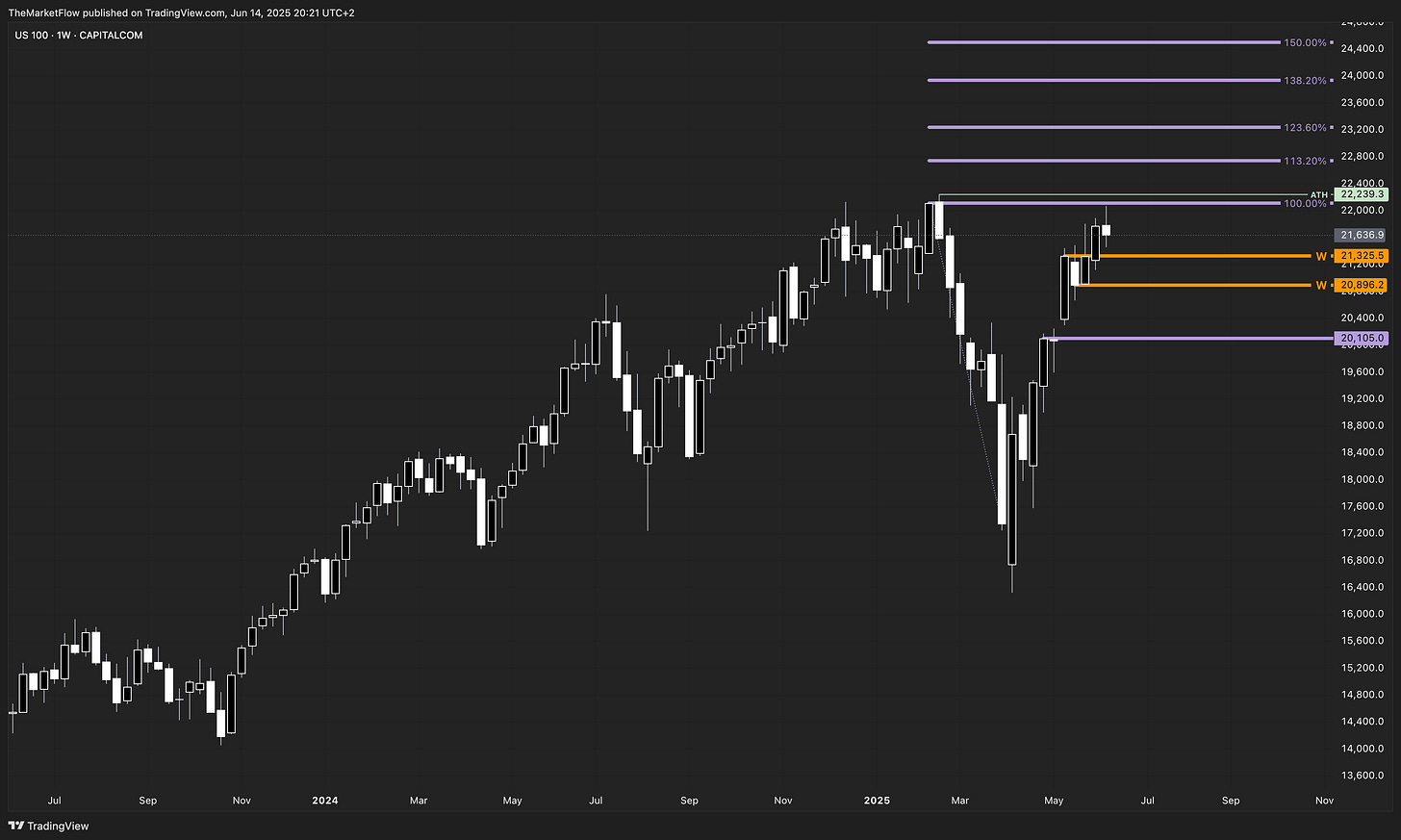

The weekly chart shows that the market is climbing towards the all-time high (ATH) and beyond, with Fibonacci expansion targets active above the target Fibonacci 100% level. The weekly pivot zone (21,325.5 – 20,896.2) serves as the primary support, and price is trading well above it, maintaining the bullish outlook.

The Daily Timeframe

On the daily chart, the long trend remains valid, despite the presence of a corrective structure. The market recently printed a daily breakdown zone—an important reaction area where both the daily countertrend line and structure converge. This confluence offers a potential turning point for the next wave of bullish expansion.

Countertrend on H4

Zooming into the H4, the short countertrend lines drawn on both daily and H4 timeframes will be broken if the market significantly breaks above the daily breakdown (green) at 21,855.

A move like this confirms the next target zones derived from the H4 Fibonacci projections. These targets align with the previous weekly high and the ATH at 22,239.3.

As long as the market trades above the weekly pivot zone, the bullish scenario remains intact, and traders may consider setups in the direction of the prevailing trend.

Short trades are risky, until the price breaks below the weekly pivot zone, which would invalidate the bullish thesis and signal a potential shift to deeper correction.

Structure Summary & Key Levels

Primary trend: Long (weekly, daily) - Short countertrend (H4)

Key support: Weekly pivot zone (21,325.5 – 20,896.2)

Bullish trigger: Break of the daily breakdown (green zone) at around 21,855

Short setup invalid unless: Market drops below weekly support zone

If you enjoy this kind of multi-timeframe market structure analysis, please consider liking the post and leaving a comment. I’d also be happy to analyze a market of your choice—just hit reply or comment, and let me know!