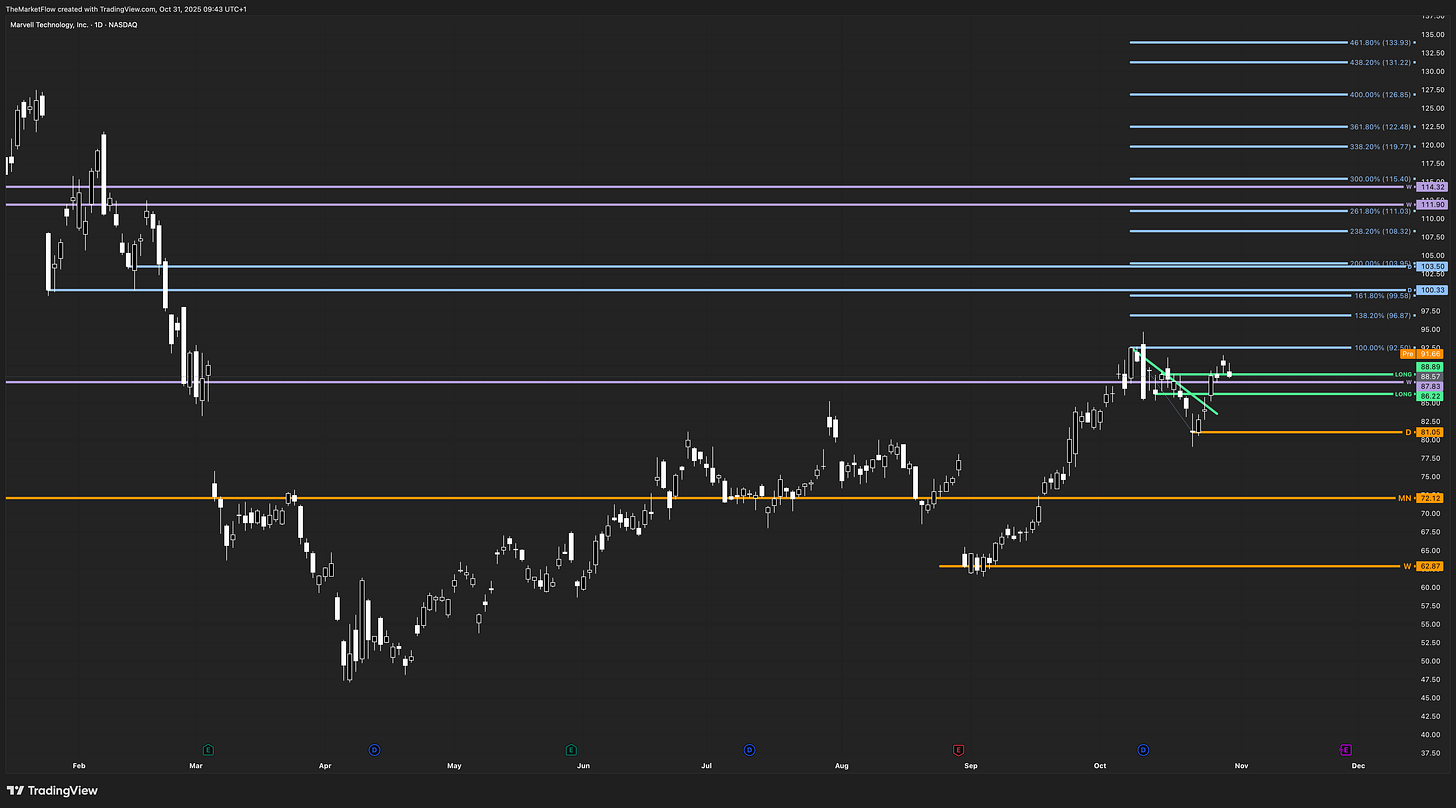

MRVL | Daily Long Triggered — Early Expansion Pending H4 Correction

Daily structure shifts into expansion as weekly reclaim approaches; sustained strength above 88.57 defines path toward 100+ zone.

The Market Flow | October 31, 2025

Company Overview

Marvell Technology Inc. designs and develops semiconductors for data infrastructure, serving cloud, enterprise, automotive, and carrier markets. Its revenue primarily derives from networking, storage, and custom silicon solutions addressing AI and high-speed connectivity demand. The company continues expanding in automotive Ethernet and 5G applications, reinforcing its presence in high-performance data processing.

Marvell fits the stalwart category — a mature, innovation-driven technology business characterized by steady cash flow growth and product-cycle leverage, focused on maintaining competitive leadership through design wins and silicon integration rather than hypergrowth expansion.

Video Analysis

Technical Overview

Monthly:

The March decline broke the prior pivot but was reclaimed through subsequent upward waves, maintaining the broader bullish sequence. The monthly structure remains intact, with bias long above the MN pivot at 72.12.

Weekly:

The market is retesting the previous breakdown at 87.83, which was weakly violated two weeks earlier. A firm weekly close above this level would confirm a structural reclaim, aligning with the active weekly bullish trend. The next long-term target aligns with the upper breakdown zone between 110.90–114.32.

Daily:

A decisive bullish impulse on October 27 broke the countertrend line and triggered the prior pivot zone (LONG 86.22–87.83). This candle confirmed directional intent and activated the daily structure. However, with only one active impulse wave, the setup remains in the early expansion phase — making a shallow H4 countertrend retracement structurally healthy before continuation. As long as price sustains above H4 88.57, the bias remains constructive for a path toward 96.87–100.33 and eventually the weekly zone near 110.

H4:

The H4 trend remains bullish, holding above the pivot at 88.57. The trigger was confirmed outside RTH, so the structure is valid but awaiting RTH validation for liquidity-based confirmation. Pullbacks into the trigger zone may provide scaling opportunities within the existing directional bias if higher-timeframe alignment persists.

Trade Structure & Levels

Bias: Long above W 87.83

Phase: Early Expansion (awaiting H4 retracement)

Trigger: D close above 87.83 (confirmed Oct 27)

Invalidation: D close below 81.05

Path → 93.79 → 96.87 → 100.33 → 110.90–114.32

ATR(14D): 2.65

Volume(20D): 10.2M

Risk & Event Context

Semiconductor earnings next month and macro releases (ISM, nonfarm payrolls) could drive volatility. Broader technology sentiment remains linked to Treasury yield behavior — a stable yield environment would support follow-through of this structural breakout.

Conclusion

MRVL has triggered on the Daily timeframe with a significant bullish impulse on October 27, initiating early expansion. With only one active wave in play, participants may either begin with reduced exposure or await a developing H4 countertrend for potential re-entry. Sustained strength above 88.57 confirms the setup’s validity toward the 100+ zone.

This publication is provided for informational and educational purposes only and does not constitute investment advice, a solicitation, or a recommendation to buy or sell any security, derivative, or financial instrument. The analysis and opinions expressed reflect the author’s views at the time of writing and are subject to change without notice.

All information is derived from publicly available sources believed to be reliable, but accuracy and completeness are not guaranteed. Past performance is not indicative of future results, and no representation or warranty is made regarding future price behavior or outcomes.

Readers are solely responsible for their own investment decisions and should consult a qualified financial advisor before acting on any information contained herein.

The author and/or affiliates may hold, trade, or have a financial interest in the securities or instruments mentioned in this publication. Neither the author nor any associated party accepts liability for any direct or consequential loss arising from the use of this material.