Liquidity Is Drying Up

What the Fed’s RRP Collapse and Treasury Buybacks Mean for Markets

In recent days, two important developments have highlighted just how fragile U.S. liquidity conditions have become. Both were flagged by The Kobeissi Letter and supported by data from Bloomberg and the U.S. Treasury. Together, they paint a clear picture: the buffer of excess liquidity that helped sustain markets over the past two years has nearly vanished, while the Treasury is stepping in more aggressively to keep the world’s largest bond market functioning.

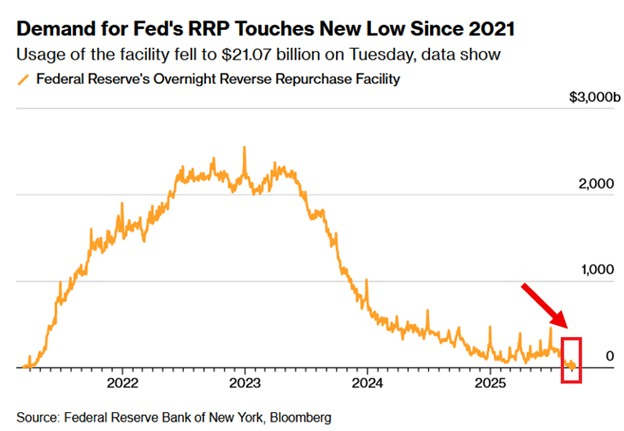

The Fed’s RRP Facility Is Nearly Empty

The Federal Reserve’s Overnight Reverse Repo Facility (RRP) dropped to just $21 billion this week, the lowest level since April 2021. That’s a decline of more than $2.5 trillion since late 2022.

The RRP is a key measure of excess liquidity. When balances are high, cash is abundant; when balances fall, liquidity is being drained back into markets. The collapse in usage reflects institutions pulling cash to buy the surge of Treasury bills needed to finance the U.S. deficit.

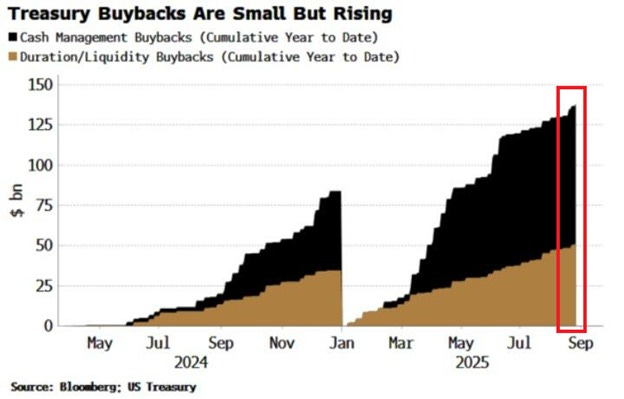

Treasury Buybacks Are Accelerating

At the same time, the U.S. Treasury has repurchased a record $138 billion in bonds year-to-date, already surpassing the $79 billion total from all of 2024.

The buyback program aims to manage cash flows and improve market functioning by retiring older, illiquid securities and replacing them with fresh issues. In July, Treasury said it would double buybacks in the 10- to 30-year maturity range, reflecting mounting stress at the long end of the curve.

Implications for Bonds

With the RRP nearly empty, new issuance will need “real” investor demand → yields face upward pressure.

Buybacks temporarily improve trading conditions but confirm the market’s dependence on intervention.

Expect higher volatility as deficit financing collides with depleted liquidity buffers.

Implications for Equities

Shrinking liquidity is a headwind for risk assets.

Higher bond yields erode the relative attractiveness of equities, especially growth and tech.

If Treasury market stability looks artificial, risk premiums could rise across all asset classes.

The Bottom Line

The drawdown in Fed RRP usage and the surge in Treasury buybacks both underscore a tightening liquidity environment. The Treasury market is increasingly reliant on official support, while equities face the dual challenge of less liquidity and higher yields.

Excess liquidity is gone. Intervention is the only thing keeping markets stable.

Trader’s Take

Liquidity is no longer a tailwind — it’s a risk factor.

For bonds, that means higher yields and more volatility. For equities, it means valuations will be harder to justify without earnings growth.

In this environment, I’m focused on how fast liquidity drains relative to Treasury issuance — because that pace will decide whether markets bend or break.

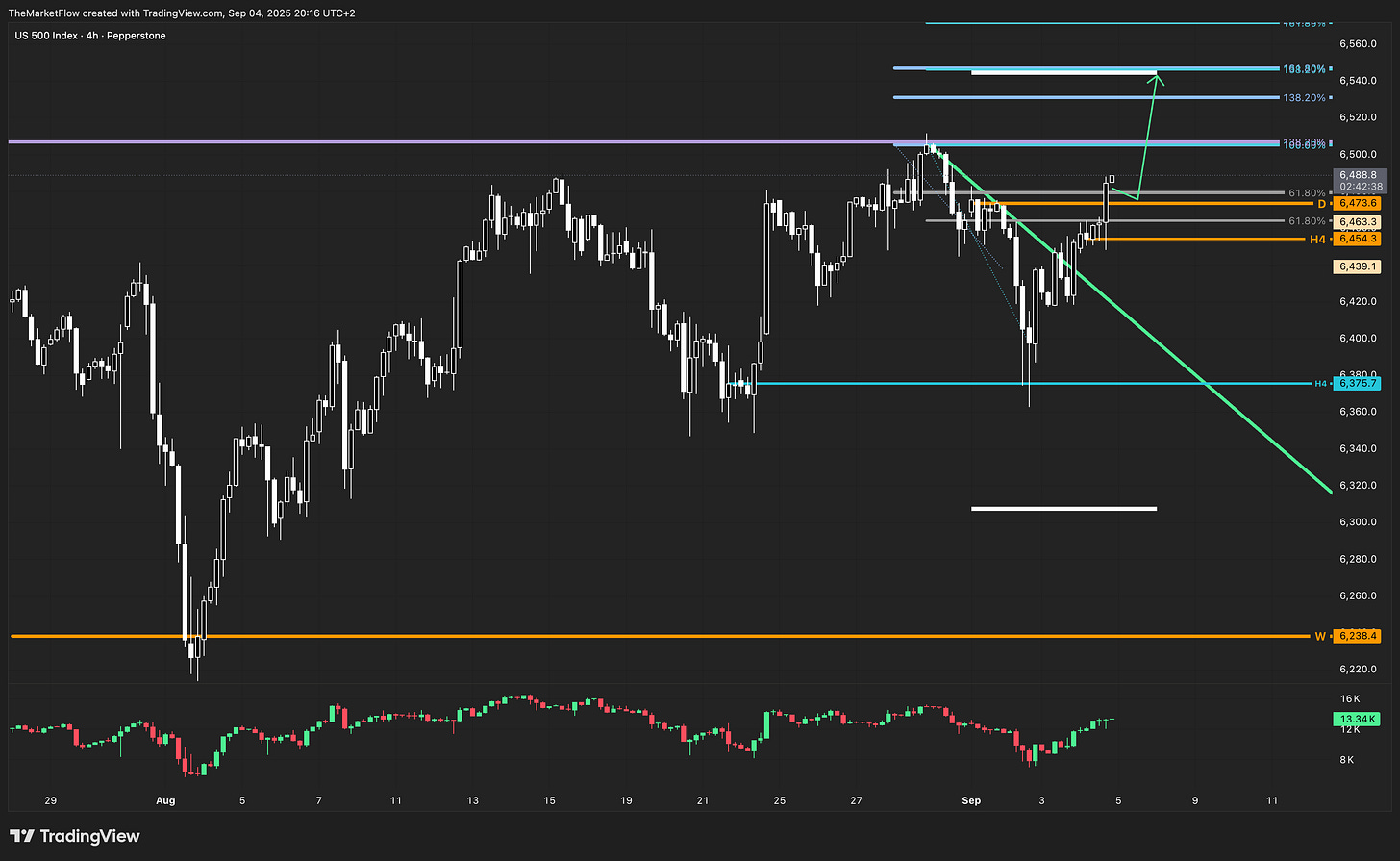

The US Stock Market is still in an uptrend, though…