JPM | Multi-Timeframe Expansion Alignment

Confirmed continuation above countertrend and expansion level, targeting daily Fibonacci 138.2% (324.44).

The Market Flow | November 7, 2025

Company Overview

JPMorgan Chase & Co. is a leading global financial institution providing banking, investment, and asset management services. Its revenue streams are diversified across consumer banking, commercial banking, corporate investment, and wealth management segments. The firm maintains one of the strongest balance sheets in the banking sector, supported by significant scale, digital infrastructure, and global operations.

JPMorgan Chase fits the stalwart category — a mature, well-capitalized financial leader with stable earnings and consistent dividend growth, benefiting from structural strength and global economic exposure.

Technical Overview

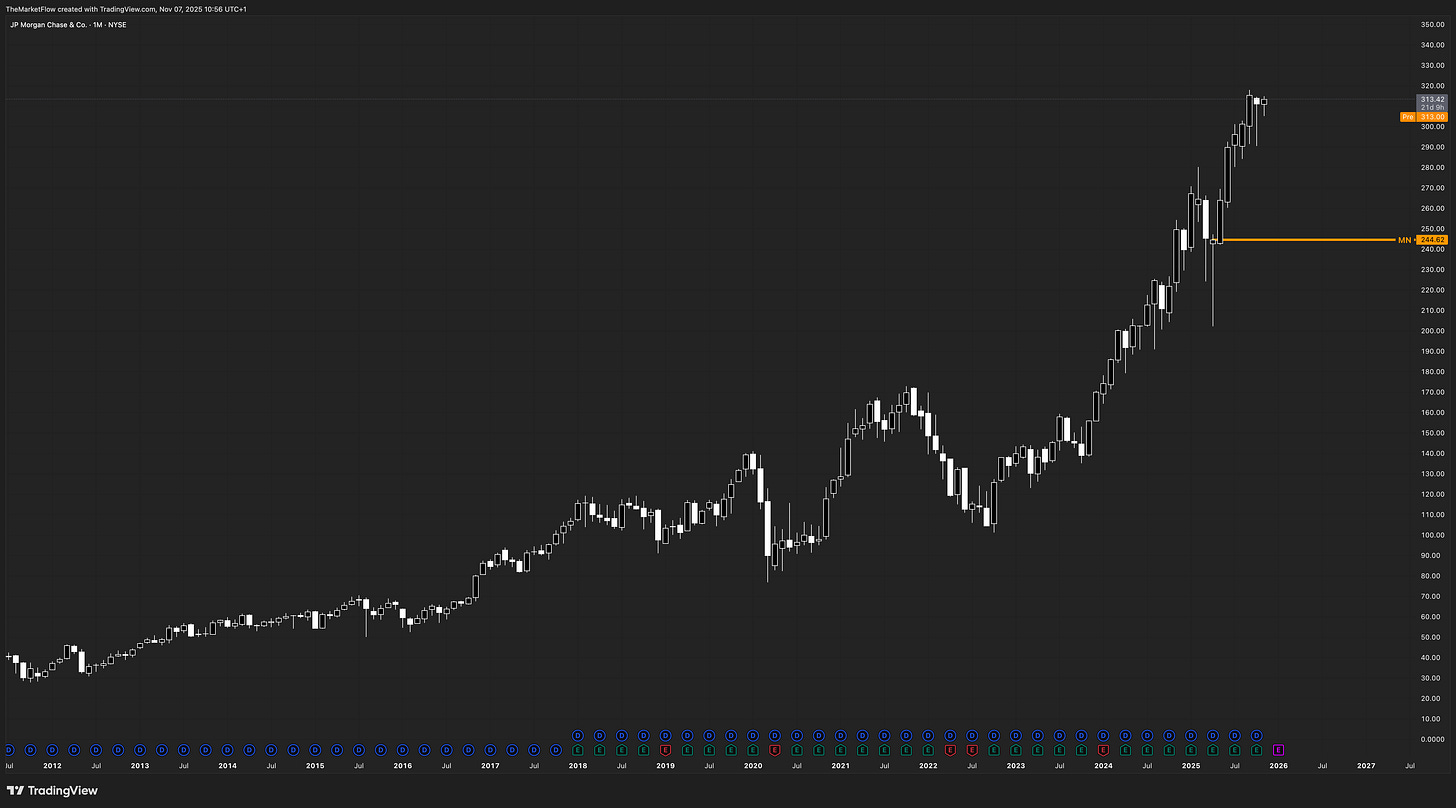

Monthly

The broader structure remains firmly bullish, sustaining an active expansion above the monthly pivot at 244.62. Momentum persists with no visible exhaustion or pivot challenge. Monthly structure maintains full alignment with the ongoing uptrend, confirming continuation within the established expansion phase.

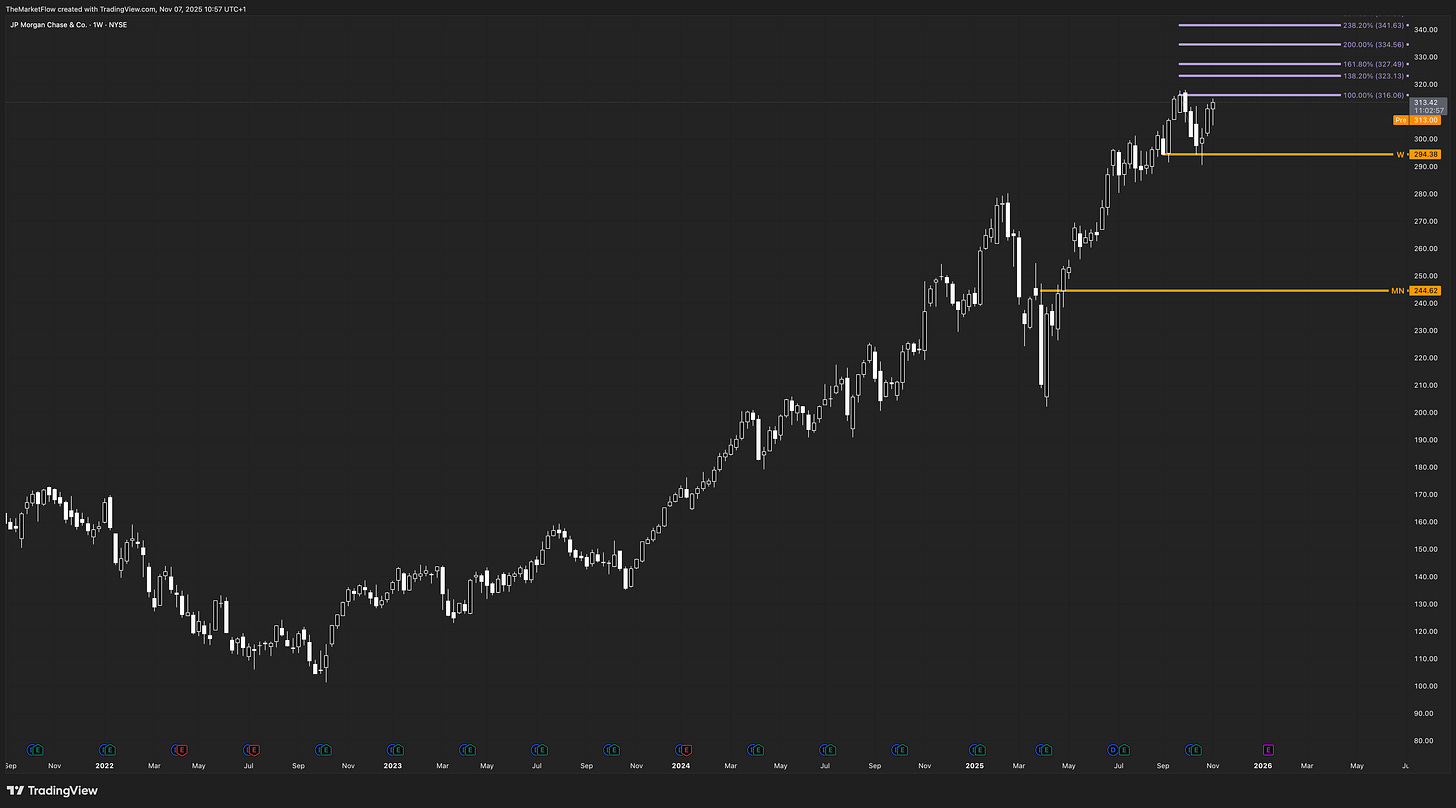

Weekly

Weekly flow remains constructive above the pivot at 296.38. The 100% expansion level at 316.01 has been achieved, and the current leg is extending toward 138.2% (323.13) and 161.8% (327.49). Structure confirms higher timeframe expansion continuity, with no countertrend developments threatening the primary impulse.

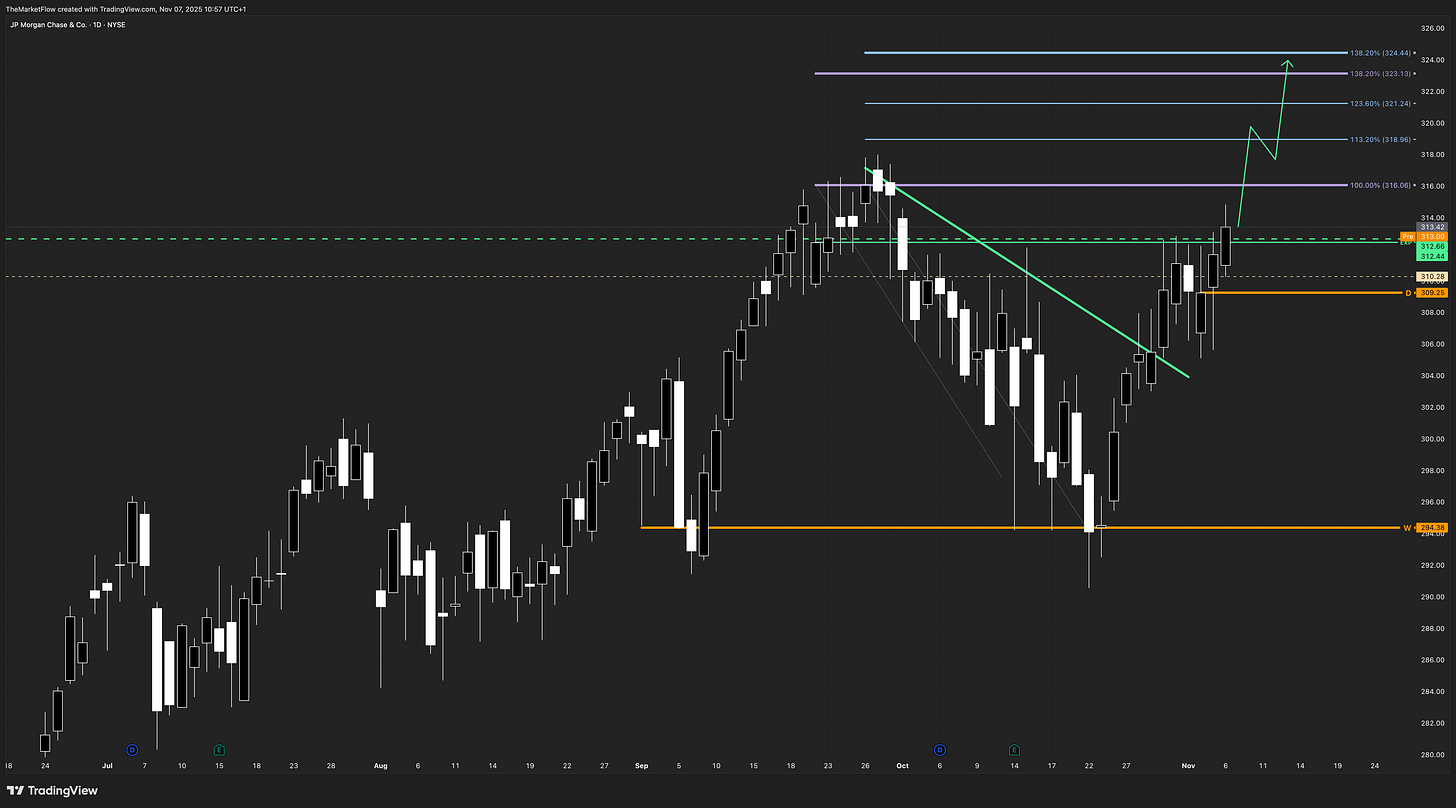

Daily

A confirmed break above the countertrend and the daily EXP 312.44 marks the transition into full expansion. The daily pivot at 309.25 now defines structural invalidation for the ongoing expansion leg. Wave alignment remains clean and impulsive, projecting continuation toward the 138.2% (324.44) extension zone within the next 1–2 weeks, supported by confluence with the weekly expansion targets.

The only near-term concern is the top wick on the last daily candle, which reflects minor profit-taking pressure following the breakout. However, structure remains intact while closes continue to hold above the pivot, maintaining expansion bias.

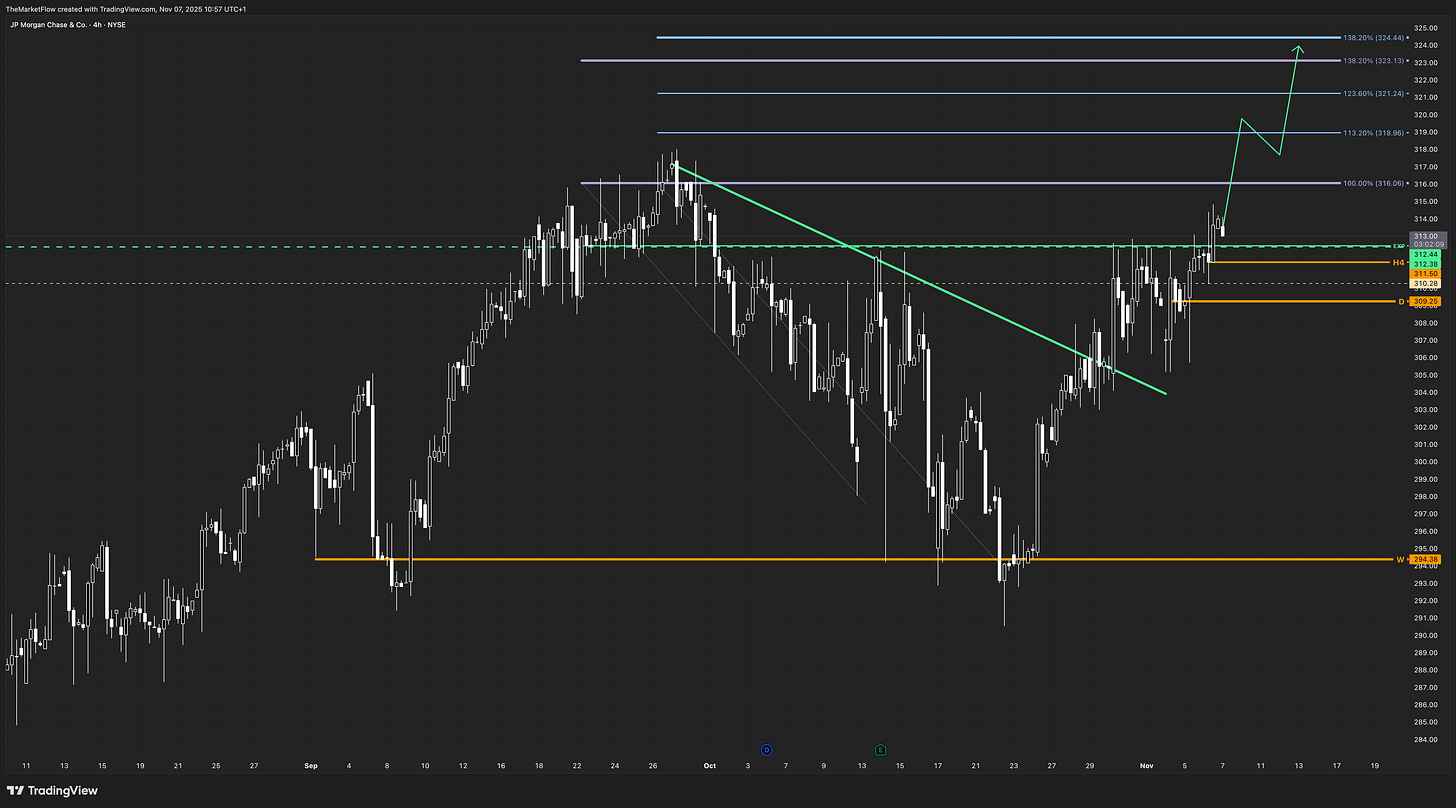

H4

Lower timeframe flow confirms alignment, trading above the H4 pivot 311.50 and showing reacceleration after retesting the breakout area. The impulsive sequence remains intact, validating continuation toward 323.13–324.44. The H4 structure supports the daily expansion, with local consolidation above the pivot acting as higher-timeframe continuation energy.

Trade Structure & Levels

Bias: Long above weekly pivot 296.38

Phase: Expansion

Trigger: Daily close above EXP 312.44 (confirmed)

Invalidation:

Daily close below 309.25 (structural), or

H4 close below pivot 311.50 (secondary)

Path → 316.06 → 318.96 → 321.24 → 323.13 → 324.44

ATR(14D): 6.80 Volume(20D): 9.7M

Risk & Event Context

Macro catalysts include U.S. CPI and employment data driving yield curve expectations, with sector momentum still influenced by rate outlook. No immediate corporate earnings releases are scheduled for JPMorgan. Broader financial sector liquidity remains supportive of ongoing expansion.

Conclusion

JPMorgan Chase remains in a confirmed multi-timeframe expansion, supported by aligned wave structure and clean breakout above both the countertrend and expansion level. The higher timeframe path targets 323.13-324.44, with structure remaining valid while above 311.50 intraday and 309.25 on the daily close.

This publication is provided for informational and educational purposes only and does not constitute investment advice, a solicitation, or a recommendation to buy or sell any security, derivative, or financial instrument. The analysis and opinions expressed reflect the author’s views at the time of writing and are subject to change without notice.

All information is derived from publicly available sources believed to be reliable, but accuracy and completeness are not guaranteed. Past performance is not indicative of future results, and no representation or warranty is made regarding future price behavior or outcomes.

Readers are solely responsible for their own investment decisions and should consult a qualified financial advisor before acting on any information contained herein.

The author and/or affiliates may hold, trade, or have a financial interest in the securities or instruments mentioned in this publication. Neither the author nor any associated party accepts liability for any direct or consequential loss arising from the use of this material.