IBKR | Daily Countertrend Break Toward Expansion

Confirmed Daily Breakout Within Ongoing Expansion

The Market Flow | November 2, 2025

Company Overview

Interactive Brokers Group, Inc. operates an electronic brokerage platform providing trading, custody, and clearing services to individual and institutional clients worldwide. Its revenue derives mainly from commissions, net interest income on client balances, and market-making spreads. The firm’s technology-driven model emphasizes low-cost execution and multi-asset access across global markets.

IBKR fits the stalwart category — a mature, profitable financial technology company expanding steadily through international diversification and platform enhancements rather than aggressive market capture.

Technical Overview

Monthly

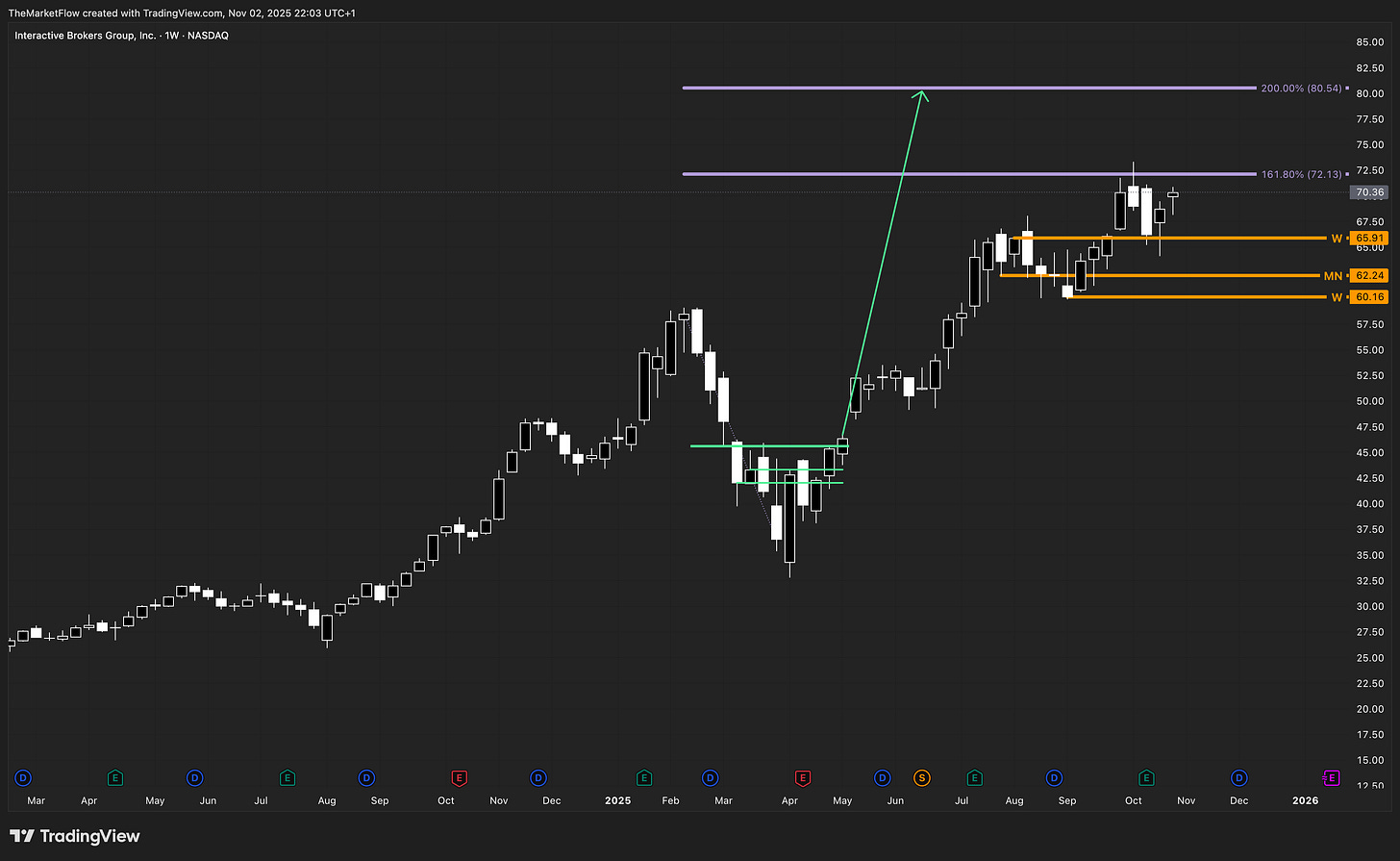

IBKR continues its upward expansion phase, sustaining a series of higher monthly closes above prior pivot levels. The active monthly pivot at 62.24 remains intact, and structure extends toward the 70.36 region, confirming bullish alignment. Price remains above both the pivot and prior compression zone, supporting continuation bias.

Weekly

Weekly flow confirms expansion beyond the 161.8% Fibonacci projection at 72.13, with the next measurable target at the 200% extension near 80.54. Pivot zone at 62.24-65.91 reinforce structural support zones. As long as price sustains above the 62.24 pivot, the weekly structure remains expansionary.

Daily

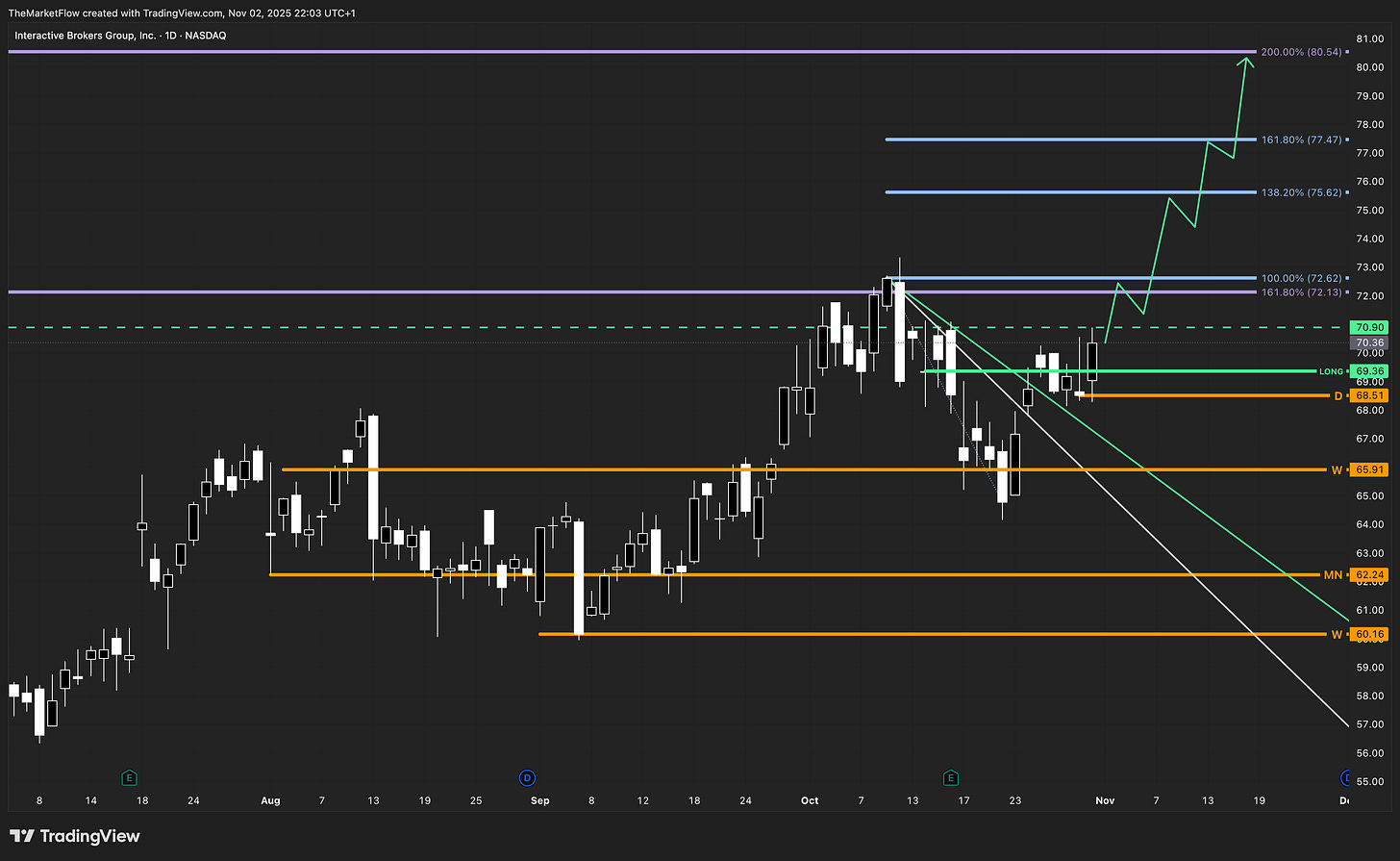

The daily timeframe shows a clean countertrend break and a confirmed close above the descending structure and trigger zone at 69.36, validating upward continuation. Price has reclaimed the 100% expansion zone (72.63) with potential path toward 75.62, 77.47, and 80.54 (Fibonacci extensions).

The green dashed level at 70.90 marks the Value Area High (VAH) of the daily countertrend structure.

Trade Structure & Levels

Bias: Long above weekly pivot 65.91

Phase: Expansion

Trigger: Daily close above 69.36 (confirmed)

Invalidation: Daily close below 68.51

Path → 72.63 → 75.62 → 77.47 → 80.54

ATR(14D): 2.30 Volume(20D): 1.25M

Risk & Event Context

IBKR’s structure remains technically driven, but upcoming macro events such as U.S. CPI and FOMC guidance could influence volatility across financial sector equities. The next quarterly earnings cycle will also provide clarity on interest income trends and global client growth — both key drivers for continued expansion momentum.

Conclusion

IBKR maintains structural expansion across all observed timeframes. Confirmation above the daily trigger sustains upward flow toward 200% Fibonacci extensions. Only a confirmed daily close below 68.51 would invalidate the current bullish structure and reclassify the setup into correction.

Disclaimer

This publication is provided for informational and educational purposes only and does not constitute investment advice, a solicitation, or a recommendation to buy or sell any security, derivative, or financial instrument. The analysis and opinions expressed reflect the author’s views at the time of writing and are subject to change without notice.

All information is derived from publicly available sources believed to be reliable, but accuracy and completeness are not guaranteed. Past performance is not indicative of future results, and no representation or warranty is made regarding future price behavior or outcomes.

Readers are solely responsible for their own investment decisions and should consult a qualified financial advisor before acting on any information contained herein.

The author and/or affiliates may hold, trade, or have a financial interest in the securities or instruments mentioned in this publication. Neither the author nor any associated party accepts liability for any direct or consequential loss arising from the use of this material.