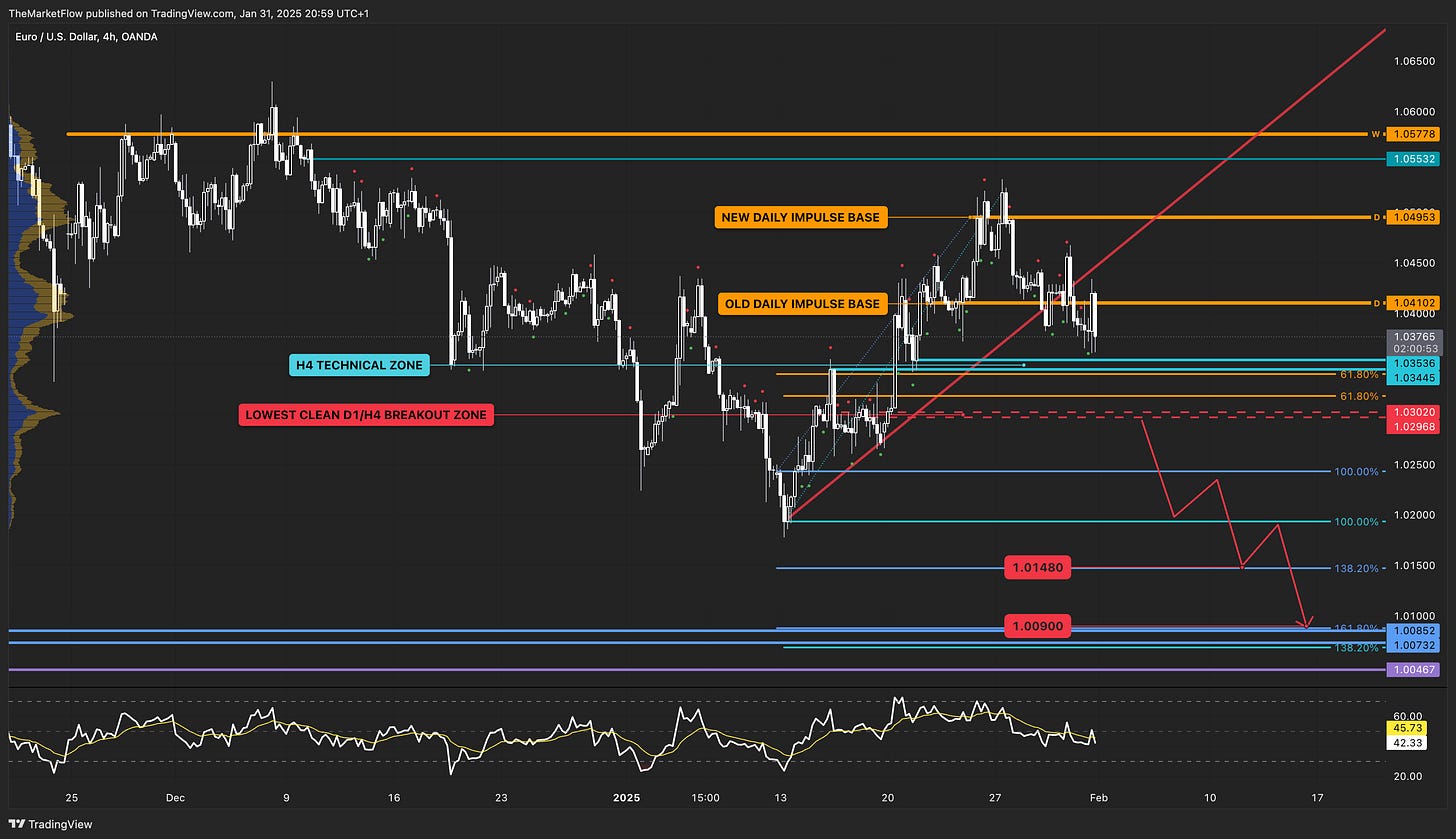

📉 EURUSD // primary short trend

There is still time to prepare for the primary short expansion phase

Key Chart (H4)

The weekly trend is bearish, and the daily has broken the long structure.

The market is in a minor short trend, that may speed up with a significant break below the lowest clean (not yet tested) daily and H4 breakout zone (red dashed).

From there, the H4 and the daily target fibo levels are valid that align well with a daily / H4 breakout zone.

Check out this long-term technical outlook on TradingView.

Key Fundamentals

Summary

The EUR/USD currency pair has come under pressure due to escalating U.S. tariff threats and diverging monetary policies between the Federal Reserve and the European Central Bank (ECB). The U.S. dollar has strengthened amid these developments, while the euro struggles with a dovish ECB stance and economic uncertainties in the Eurozone.

Key Factors

U.S. Tariff Threats:

President Donald Trump has announced a 25% tariff on imports from Mexico and Canada, aiming to address issues such as illegal immigration and fentanyl trafficking, which has bolstered the U.S. dollar’s safe-haven appeal (Reuters).

Divergent Monetary Policies:

The Federal Reserve has maintained its interest rates, citing a strong U.S. economy, while the ECB has cut its benchmark rate by 25 basis points to counteract the Eurozone’s economic slowdown. This divergence has strengthened the U.S. dollar relative to the euro (Reuters).

Eurozone Economic Challenges:

The Eurozone is facing high energy costs, political instability, and external threats from global powers, which have weakened investor confidence in the euro (Wall Street Journal).

Market Sentiment:

The U.S. dollar has risen against major currencies as markets brace for potential tariff hikes. Meanwhile, stock indexes have posted gains, with Apple performing notably well (Reuters).

Actionable Insights

Bullish Case for EUR/USD:

If trade tensions de-escalate, the euro could recover against the U.S. dollar as market risk appetite improves.

Positive economic data from the Eurozone, such as stronger GDP growth or inflation data, could bolster the euro’s value.

Bearish Case for EUR/USD:

If the U.S. implements its 25% tariffs, the dollar could strengthen further, leading to a decline in EUR/USD.

Continued monetary policy divergence between the Fed and ECB could push the euro lower, especially if the ECB remains dovish while the Fed keeps rates steady or moves higher.