EUR/USD: Bullish Engine Reignites After Shallow Correction

Breakout structure confirmed across all timeframes – short-term momentum points to 1.15+, with buyers firmly in control above the daily pivot.

Structure-led bullish continuation unfolding across all timeframes

Weekly Timeframe

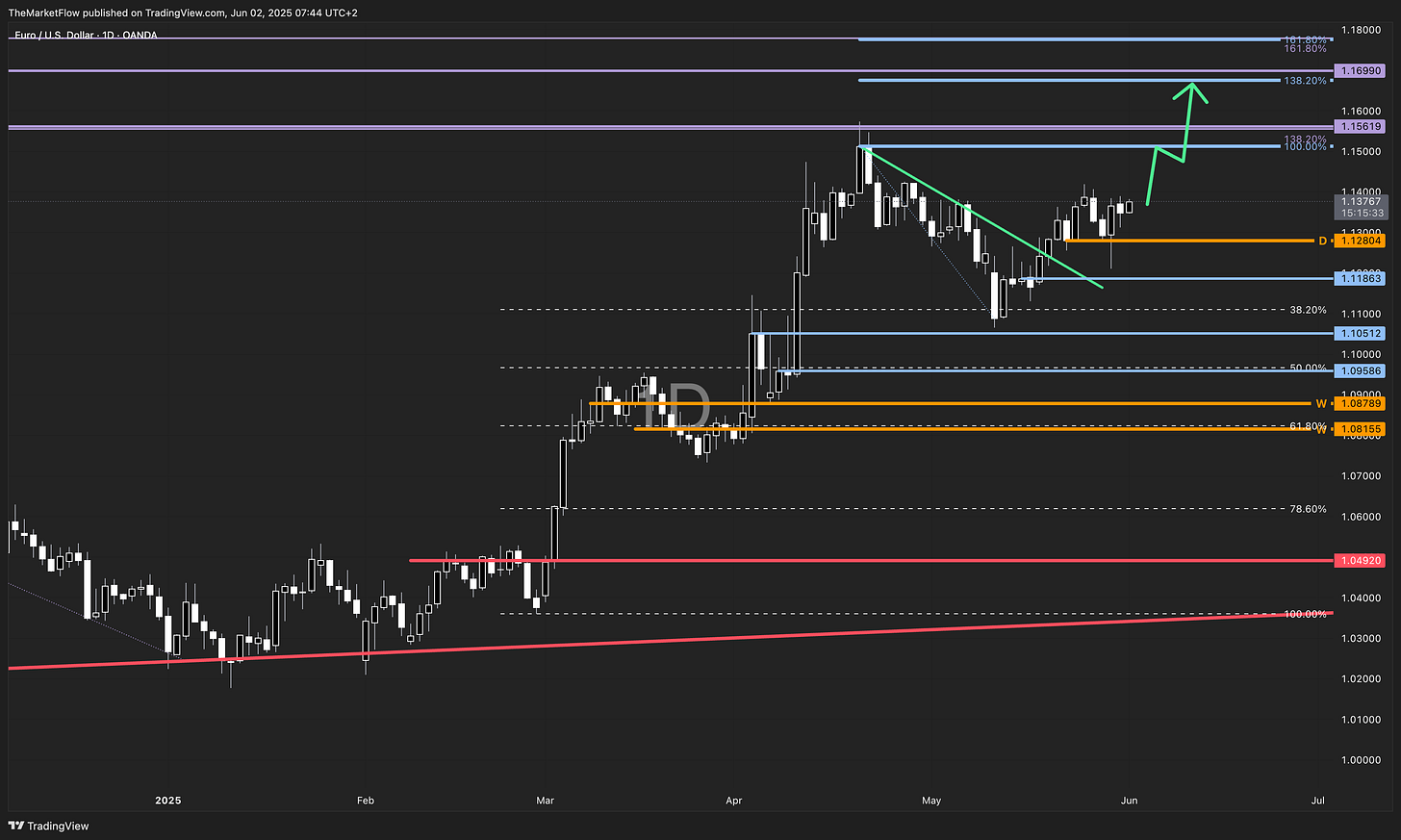

The broader structure shows a strong bullish impulse breaking above a long-standing weekly countertrend line. The rally reached and respected the 138.2% Fibonacci extension level, triggering only a shallow correction that held above the 38.2% retracement level. This confirms a structurally strong trend where buyers remain in control, and deeper retracements are currently being rejected.

Daily Timeframe

The daily chart confirms the bullish narrative. The market has completed its correction and broke through the daily countertrend line, flipping the structure back to bullish. Price is holding above key support levels, particularly the daily pivot zone around 1.12804, which now acts as the primary invalidation point for this bullish scenario.

Targets are clearly aligned with the Fibonacci expansion levels:

1.15150 – Daily Target Fibonacci 100%

1.16700 – Daily Target Fibonacci 138.2%

H4 Timeframe

The H4 structure shows early bullish momentum resuming after a brief correction. The market has successfully reclaimed the last major H4 breakdown level and broke out of a local descending trendline. This suggests a new short-term impulse is underway.

Fibonacci targets on this timeframe provide the next upside projections:

1.14750 zone – H4 Target Fibonacci 138.2%

1.15150 – H4 Target Fibonacci 138.2% and confluence with Daily Target Fibonacci 138.2%

The move remains valid and structurally intact as long as the price holds above the Daily Pivot (1.12804). A break below this level would open the path to deeper retracements toward the Weekly Pivot Zone (1.08789 – 1.08155).

Outlook

Bias: Bullish continuation

Short-term targets: 1.14750 / 1.15150

Medium-term target: 1.16700

Invalidation: Daily pivot at 1.12804