Dow Jones – Daily Countertrend Develops Below Weekly Peak

Weekly trend remains long, but daily structure opens path toward key Fibonacci retracement zones

Market Overview

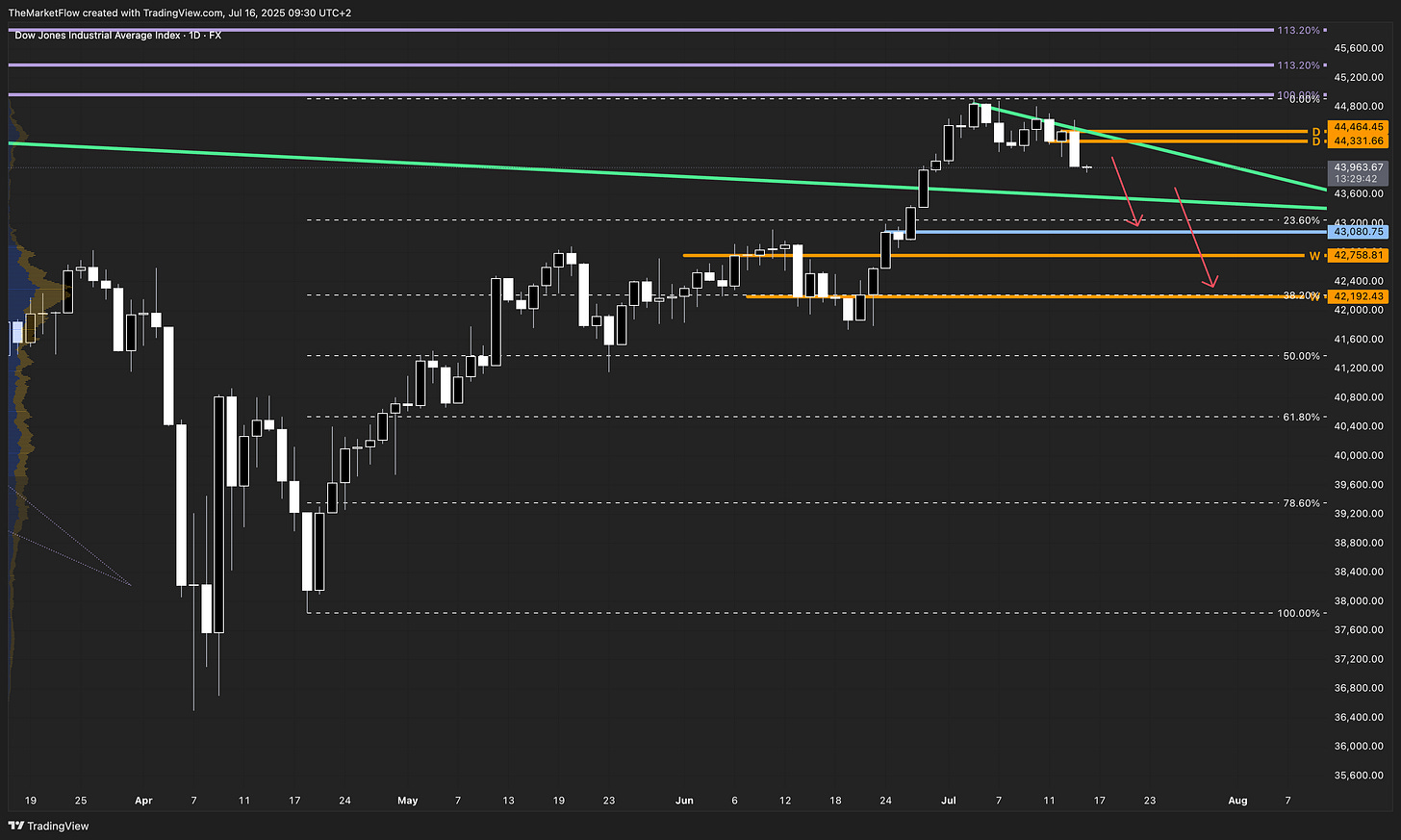

The Dow Jones Industrial Average (DJIA) remains structurally long on the weekly timeframe, having reached its most recent impulse peak. However, the daily chart shows a confirmed countertrend developing, with price breaking below a key daily support. This opens the door to a deeper retracement phase toward the clean daily breakout and correction Fibonacci levels.

Long-Term Outlook

On the weekly chart, price successfully expanded above the long-standing descending trendline and reached the 100% Fibonacci extension near 44,800. This completed the prior impulse move and validates the long trend. However, recent weekly candles now show rejection and slowing momentum, suggesting the start of a corrective phase. The key weekly pivot zone between 42,758.81 and 42,192.43 remains the primary structural reference should the correction deepen.

The Daily Chart

Price action on the daily has transitioned into a short-term bearish countertrend. After a clean breakout above 44,464.45, price failed to hold the breakout, instead breaking below the rising support line and initiating a breakdown through 44,270. This confirms a valid daily countertrend structure.

Until the daily pivot zone is reclaimed, continuation toward lower targets remains valid. The green ascending trendline and orange pivot lines previously acting as support now serve as resistance.

Trigger Conditions

Long Trigger: Daily pivot zone reclaim above 44,465

Short Trigger: H4/H1 bullish countertrend break

Target Zones

Daily Breakout and Correction Fibonacci 23.6%: 43,080.75

Weekly Pivot Zone (and 38.2% Fibonacci): 42,758.81 – 42,192.43

Validity

As long as price remains below the daily pivot at 44,464.45, the bearish countertrend remains valid. A reclaim of this level would invalidate the short setup and suggest resumption of the weekly trend.

What’s your take on Dow’s current structure? Share your view in the comments—let’s compare frameworks.