DAX – Multi-Timeframe Long Structure Intact Despite Short-Term Pullback

Monthly and Weekly Trends Hold; Daily and Intraday Charts Eye Trigger Reclaim for Expansion

Market Overview

The DAX continues to hold a multi-timeframe bullish structure. The monthly trend remains firmly intact, with price positioned above the last monthly pivot at 22,281.90. On the weekly chart, although there was a recent structure break, last week’s Marubozu candle signals strong bullish momentum, potentially marking the continuation of the broader uptrend.

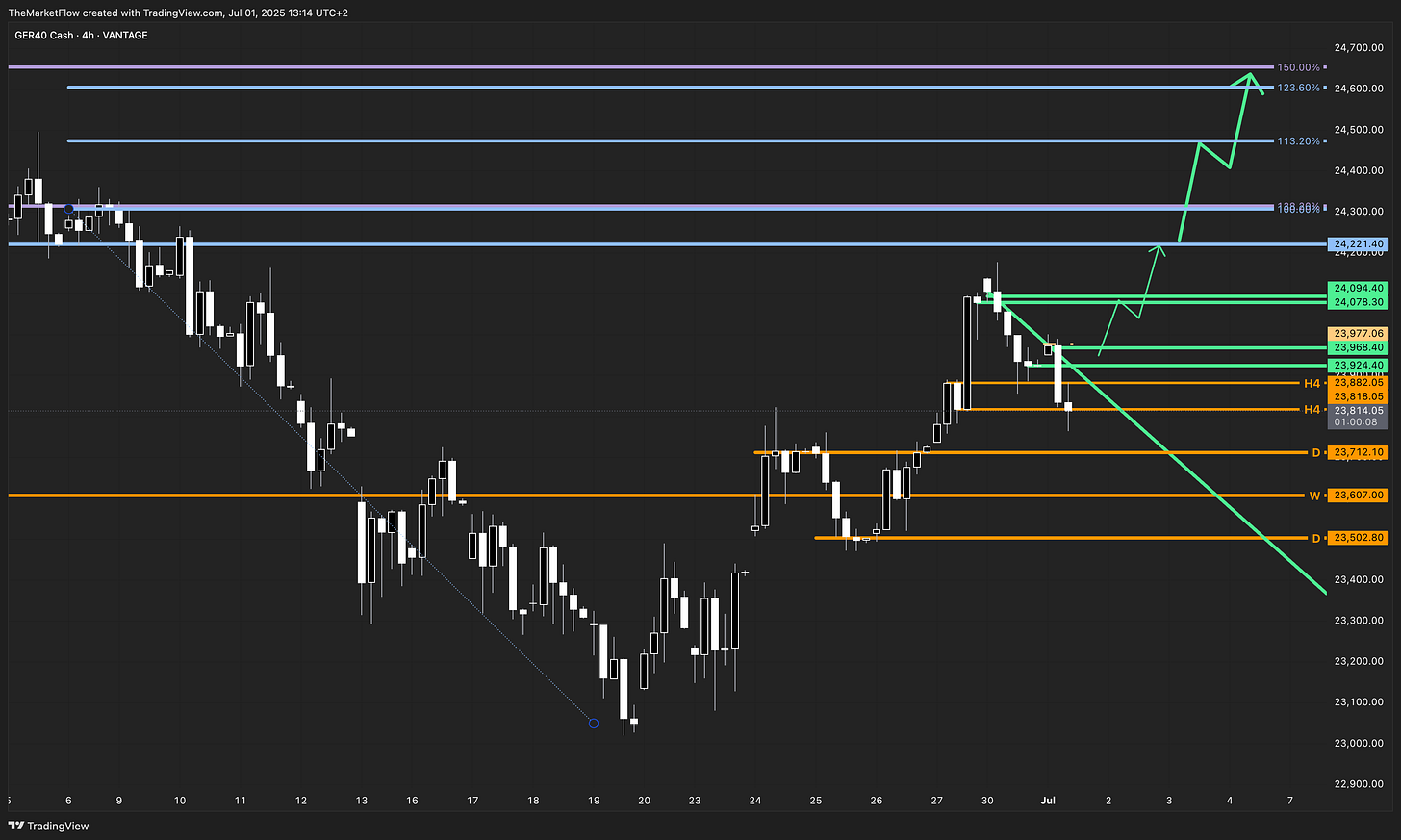

Short-term price action (H4 and H1) reflects a countertrend. The next structural validation would require a reclaim of the long trigger zones, which could set the stage for a re-entry toward higher timeframe targets.

Long-Term Outlook

Monthly: The macro trend continues to print higher highs with no recent invalidation. The last confirmed monthly pivot stands at 23,121.30, serving as a macro reference level.

Weekly: A previous structural break occurred, but the latest bullish Marubozu candle shows a firm weekly close above the former pivot at 23,121.30, suggesting bullish continuation. Target Fibonacci extensions (138.2–161.8%) project toward 24,808.7–25,081.8, with intermediate resistance at 24,504.0 and 24,294.6.

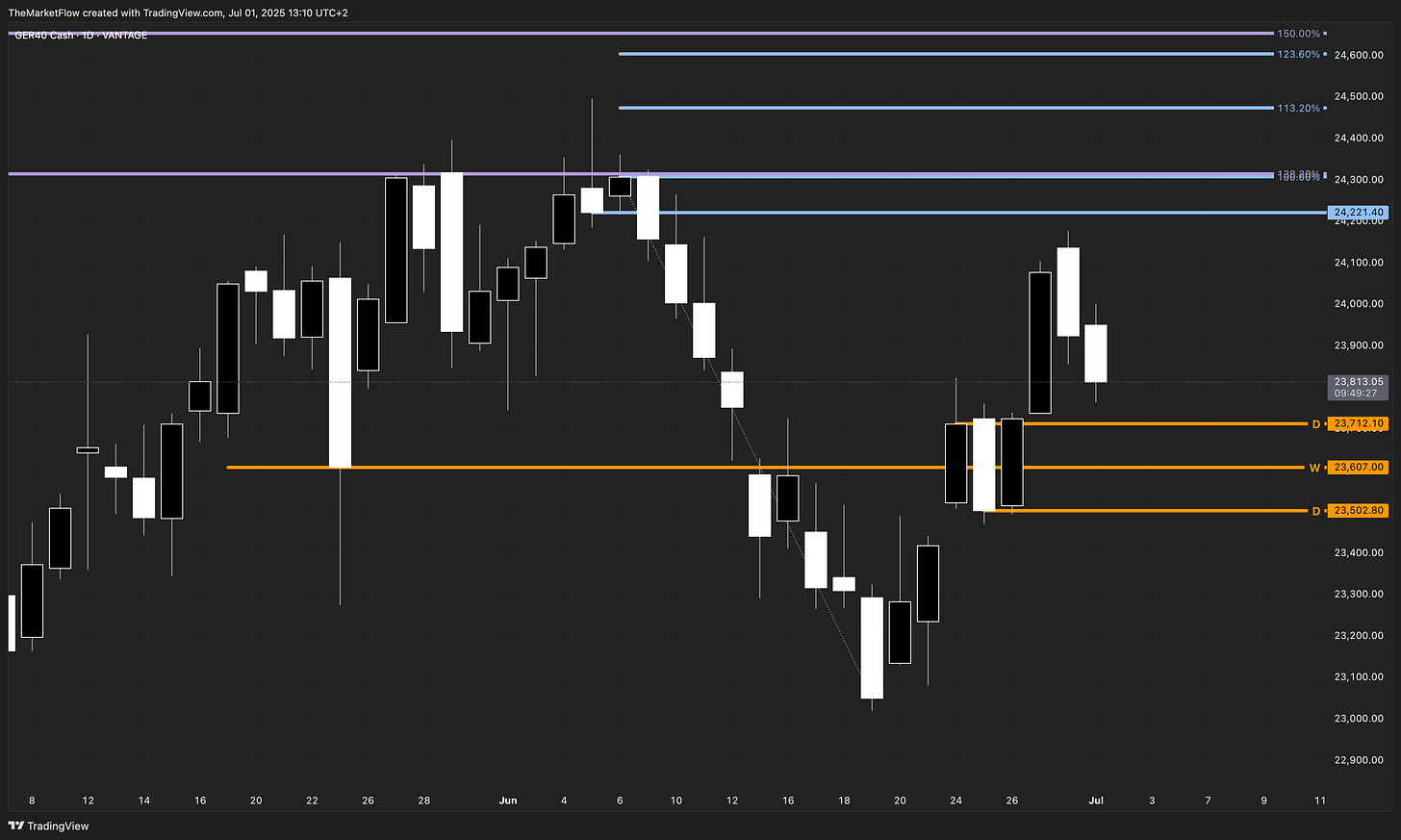

The Daily Chart

The daily trend remains in a minor bullish phase. Following a recent retracement, the market printed a clean bullish engulfing setup above the daily pivot zone (23,502.80–23,712.10). If price can hold above this zone and break above 24,221.40—the last clean daily breakdown—an expansion phase might unfold toward higher weekly Fibonacci targets.

Short-Term Dynamics

On the H4 and H1 charts, DAX is in a corrective countertrend, with price currently below the key trigger zones:

A reclaim of the long trigger zone (23,924.40–23,968.40) and break of the descending countertrend lines would invalidate the short-term pullback and potentially trigger bullish continuation toward the clean daily breakdown at 24,221.40.

Key Levels

Long Trigger: H1 trigger zone at 23,924.40–23,968.40

Short Trigger: Not specified—current structure prioritizes bullish re-entry zones

Target Zones

Daily Clean Breakdown: 24,221.40

Weekly Target Fibonacci Zone: around 24,315–24,650

Daily Target Fibonacci Zone: around 24,470, 24,600

Validity

The setup remains valid as long as price holds above the daily pivot zone (23,502.80–23,712.10). A breakdown below 22,801.00 (monthly pivot) would invalidate the long structure at the macro level.

Summary

The higher timeframe trend remains bullish, with the monthly and weekly structures supporting continuation. A short-term countertrend is underway, but reclaiming the H1 trigger zone could invite buyers back into the market, aligning intraday action with the dominant long trend.

The next critical upside level is the clean daily breakdown at 24,221.40—a break above this could reinitiate an expansion phase toward weekly target Fibonacci levels, but minor trend longs can be initiated at the H4/H1 countertrend break.

What’s your take on DAX’s short-term correction within this larger uptrend? Share your view in the comments—let’s compare frameworks.