Coffee Futures | Weekly Expansion

Weekly bullish continuation remains active above pivot as price tests the 100% Fibonacci extension toward expansion targets.

The Market Flow | November 6 2025

Technical Overview

Instrument Note:

Analysis is based on the continuous Coffee C Futures chart (KC1!), with structural levels and near-term price references derived from the current front-month contract KCZ2025.

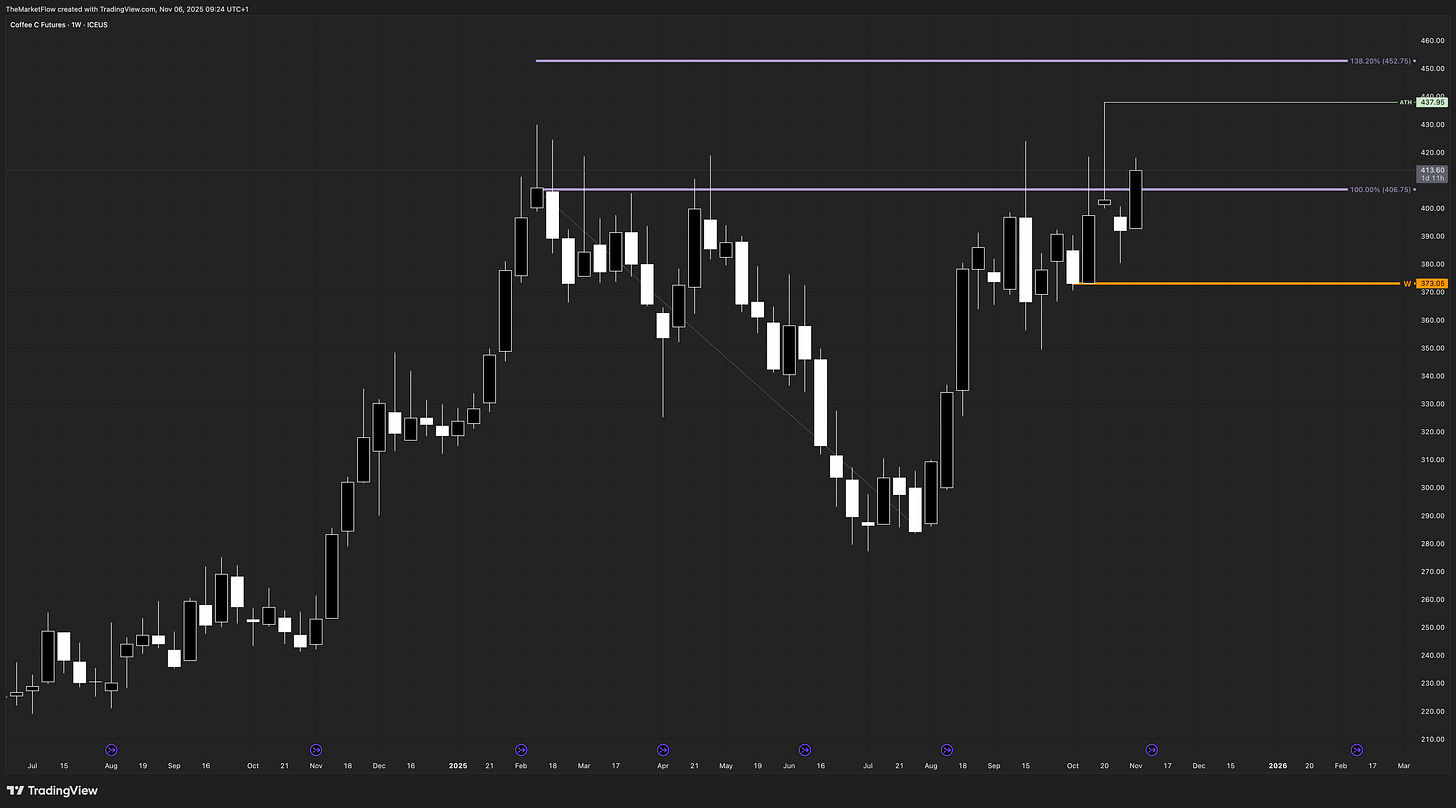

Weekly:

The primary trend remains bullish, with structure pressing against the 100 % Fibonacci extension at 406.75. Momentum stays constructive while the weekly pivot at 373.05 holds, sustaining the long bias. The phase remains in Expansion, targeting the 138.2 % zones at 437.99 and 452.75. A confirmed weekly close below 373.05 would neutralize the expansion and mark the start of corrective pressure.

Daily:

The daily structure has decisively broken the weekly 100 % Fibonacci target, supported by aligned upward waves. The daily pivot established at the recent valley defines the structural floor. Above it, flow maintains expansion potential toward 437.99–452.75. The green dashed VAH from the last correction was cleanly reclaimed, reinforcing continuation strength. A daily close below this pivot would confirm a shift into correction phase.

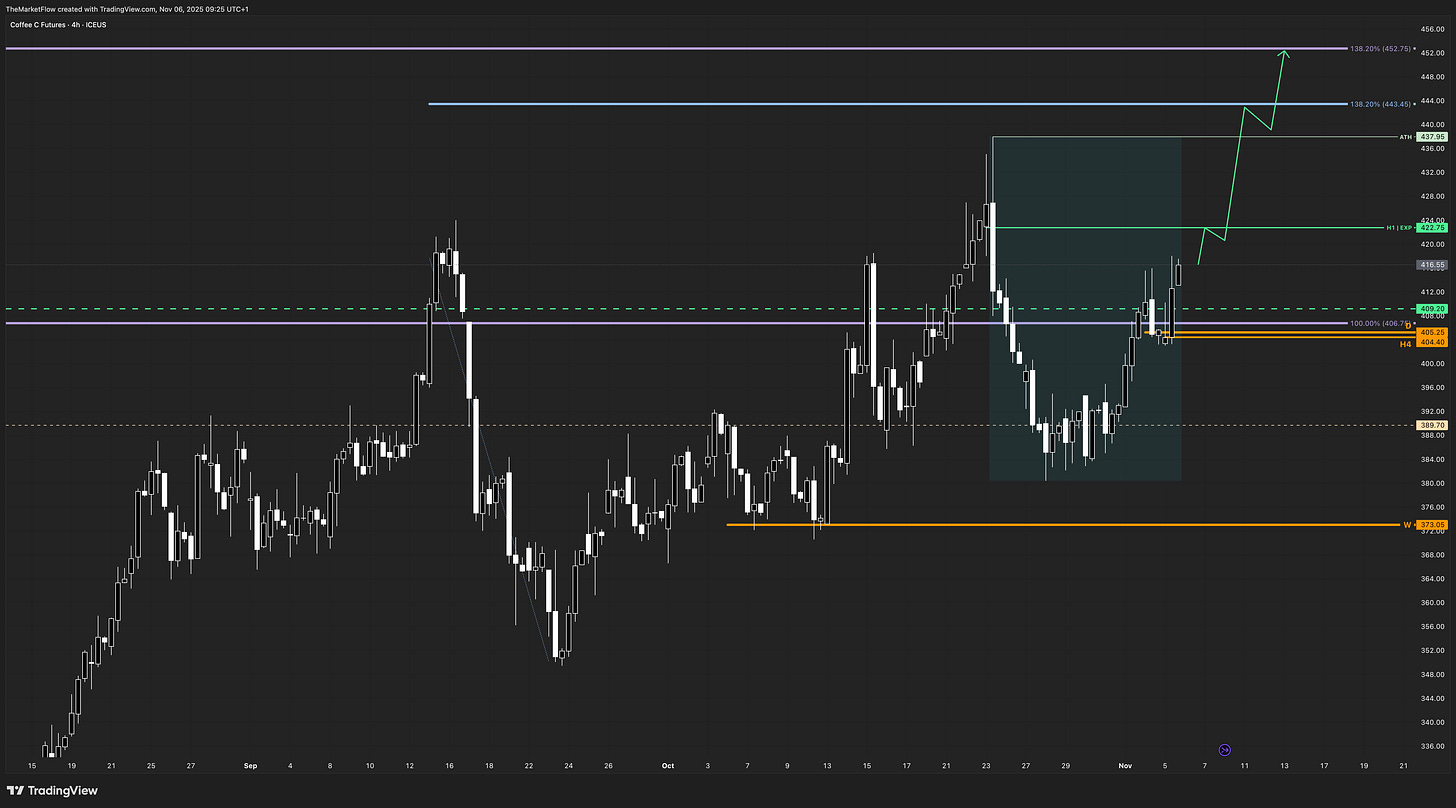

H4:

The H4 view mirrors the daily leg — a firm breakout above both the VAH and the daily 100 % Fib, confirming the continuation impulse. The H4 pivot now anchors short-term invalidation. Price action above 409.25 keeps the structure constructive toward H4 expansion at 422.75, followed by weekly objectives at 437.99 and 452.75. The trend remains upward while both pivots remain intact.

H1:

Lower-timeframe structure identifies a clean (not yet tested) H1 | EXP level at 422.75, marking the first countertrend breakdown within the ongoing expansion. This level offers potential short-term re-engagement if tested from above, though it requires active management given proximity to the prior impulse peak. A failure to hold this area could accelerate retracement toward the H4 pivot, while sustained support confirms the next expansion leg.

Trade Structure & Levels

Bias: Long above 373.05 (Weekly pivot)

Phase: Expansion

Trigger:

• Daily close above 406.75 (triggered)• H1 | EXP level at 422.75

Invalidation:

• Daily close below daily pivot (405.25)

• H4 close below H4 pivot (404.40)

Path → H1 | EXP test → 422.75 → 437.99 → 452.75

Risk & Event Context

Coffee C futures remain sensitive to Brazilian weather, harvest output, and USD volatility influencing soft-commodity pricing. Market participants should watch upcoming ICE inventory updates and commodity index rebalancing, both potential short-term volatility catalysts for KCZ2025 positioning.

Conclusion

Multi-timeframe alignment confirms active bullish expansion across weekly, daily, H4, and H1 structures. The break above the 100 % Fibonacci target keeps directional momentum intact while both pivots define clear invalidation. With the H1 | EXP providing tactical engagement potential, continuation toward upper Fibonacci zones remains favored — though management is key as price approaches the ATH region.

Disclaimer

This publication is provided for informational and educational purposes only and does not constitute investment advice, a solicitation, or a recommendation to buy or sell any security, derivative, or financial instrument. The analysis and opinions expressed reflect the author’s views at the time of writing and are subject to change without notice.

All information is derived from publicly available sources believed to be reliable, but accuracy and completeness are not guaranteed. Past performance is not indicative of future results, and no representation or warranty is made regarding future price behavior or outcomes.

Readers are solely responsible for their own investment decisions and should consult a qualified financial advisor before acting on any information contained herein.

The author and/or affiliates may hold, trade, or have a financial interest in the securities or instruments mentioned in this publication. Neither the author nor any associated party accepts liability for any direct or consequential loss arising from the use of this material.